Ubank Debit Card Review

Ubank Referral Code — $30 Bonus Free

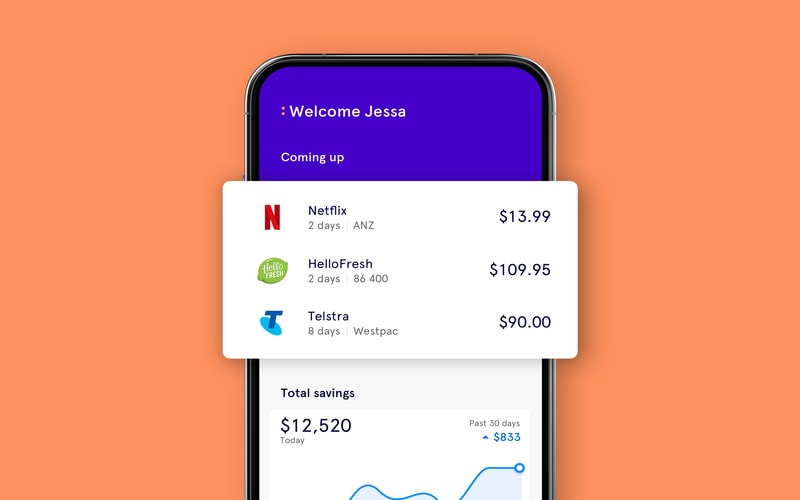

Ubank is a neobank that operates entirely via a mobile app (Ubank was previously called 86 400), with no desktop site or bank branches. Just like their name, Ubank isn’t what you’d expect from a traditional bank! Priding themselves in being one of Australia’s pioneering neobanks, 86 400 (now Ubank) stands for the number of seconds in a day.

The mobile-based bank uses innovative technology to provide customers with useful insights, personalised savings tools and minimal fees. Not to mention joining takes just minutes with no credit checks or income requirements.

Use our Ubank referral code for a free sign up bonus of $30 when you make 5 card purchases in 30 days. Use code: C7N1TAZ

- SIGN UP BONUS

$30

- ANNUAL FEE

$0: Zip, Zilch, Nada!

- FX RATE

0% on International transaction fees

- ATM FEES

$0 fee for both local and international ATMs

Ubank referral code: Get $30 cash in your new account!

Sign up for the free Ubank bank account using our Ubank referral code C7N1TAZ to get $30 when you sign up! But you'll have to be quick - it's only for a limited time! To get the $30 you have to make 5 card purchases (the transaction amount can be anything!).

Where do I enter the code?

Once you've downloaded our app, make sure you enter the Ubank promo code you received on the 'About you' screen during the sign up process.

So what’s a Neobank?

Neobanks are simply banks which are completely digital. Although the word bank is generally associated with long queues, poor customer service and countless fees, neobanks promise to be different. They don’t even have physical branches!

What they do provide is all the banking services you need from the convenience of a smartphone app. They vow to deliver app-based banking that is easy to use and beautifully designed, with the ability to quickly track your spending whilst also delivering an excellent customer experience.

Is Ubank Safe?

At first, you may be apprehensive about the idea of a fully digital bank. Although, it is important to note that neobanks are regulated by the same authorities as traditional banks – the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investment Commission (ASIC). Plus, just like traditional banks, deposits of up to $250,000 per person are protected by the Financial Claims Scheme (FCS).

Ubank is an independent company backed by Cuscal, a leading Australian payments provider. The company is predominantly owned by Cuscal, along with an Australian superannuation fund, fund managers, high net worth individuals and family offices.

Ubank Account Features

The Ubank bank account and debit card comes with all the features you would expect from a traditional bank plus more!

No Fees

All the basics of a debit card with zero card, account or ATM fees

Detailed Transaction History

Tells you who, when and how you paid

Multi-bank Activity Tracking

Track your money across other banks, not just Ubank

Account Funding

Top up your account with PayID or your BSB and Account Number

Secure Card

Instantly lock and unlock your card from the app

Contactless Payments

Support for Apple, Samsung, Google, Fitbit and Garmin

Ubank Is Great For Travel

While traditional banks will charge in excess of 3%, Ubank boasts zero currency conversion fees and zero international ATM withdrawal fees (although the ATM provider may charge a fee). Ubank uses Visa’s daily exchange rates without applying any markup.

Up to 5.1% p.a. Interest Rate

Ubank offers a decent savings interest rate of up to 5.1% p.a. (0.10% base rate plus a 5%p.a. bonus rate). To be eligible for the bonus interest you must deposit a total of at least $200 per month into any of your Ubank accounts. Interest is calculated daily and paid monthly, with bonus interest applied on balances of up to $250,000 per customer.

Eligibility Criteria

To be eligible for the Ubank bank account and debit card, you will need to meet the following requirements:

Residency

Australian citizen or permanent resident

Minimum Age

16

Personal Details

Hold either an Australian driver licence, passport or Medicare card

Is Ubank right for you?

Neobanks are setting a new benchmark for what a banking app should be, and truly showing just how far behind the big four really are. Although Ubank isn’t our favourite neobank out there, they do offer useful spending insights, various payment options, a good savings interest rate and almost zero fees.