Also known as the Fragrant Harbour, Hong Kong is home to approximately 100,000 Australians and over 600 Australian businesses, all of whom have access to the 100+ direct flights weekly between Australia and Hong Kong on Cathay Pacific, Qantas, and Virgin Australia. In this Flight Hacks exclusive, we introduce to Australians about to embark on their Hong Kong adventure to the best Hong Kong credit cards to apply for and continue earning points whilst away from home.

American Express Cathay Pacific Elite Credit Card

The only Cathay Pacific co-branded credit card on the market is a very popular choice among Hong Kong residents. Unlike most other Hong Kong credit cards, this card automatically credits your Asia Miles account with the points generated from your spend each month, avoiding pesky mileage transfer fees charged by some other banks.

Asia Miles are earned at the rate of HK$4 = 1 AM for foreign currency spend and HK$6 = 1 AM for all other expenditure. Flights booked via www.cathaypacific.com earn at HK$3 = 1 AM, which makes this card the best on the market for booking your next Cathay Pacific flight.

Other benefits include:

- Unlimited Plaza Premium Lounge access for the primary and supplementary cardholders

- Fee waiver for enrolment into the Marco Polo Club (Green Tier), the programme that grants status on Cathay Pacific

- 30day priority redemption for selected discount flight awards booked with Asia Miles

- 10% discount when purchasing Asia Miles or paying mileage renewal or transfer fees

- Special offers via American Express Selects

American Express Selects gives special offers and discounts to cardholders at certain dining, shopping and travel merchants. Examples include:

- 15% off dining spend at the Grand Hyatt, Mandarin Oriental, Hyatt Regency Tsim Sha Tsui, and InterContinental Hong Kong.

- 10% off the best available rate at The Jervois, a boutique all-suite hotel located in Sheung Wan

- 70% off at Levo Spa when you want a facial or massage

- 50% off at Mr Tomahawk when you fancy a nice steak dinner

- 9% discount at Expedia

- 8% discount at Hotels.com

- Savings on movie tickets at Broadway Circuit and AMC Pacific Place Cinemas

By applying for this card through Nic’s link, you can enjoy a sign-up bonus of 78,000 Asia Miles:

- 2,000 AM for applying via our application link and spending HK$5,000 within the first 3 months

- 1,000 AM for applying online and not troubling the postman or dusting off the fax machine

- 5,000 AM for spending HK$5,000 within the first 3 months

- 40,000 AM from a 3-month local spend bonus of HK$5 = 1 AM

- 30,000 AM from a 3-month foreign currency spend bonus of HK$3 = 1 AM

Additionally, if you apply for two supplementary cards before 31 March 2020, American Express will give you an extra 1,000 AM.

This card has an annual fee of HK$1,800 which is waived in the first year. Officially, the fee will be waived on request in future years if annual expenditure on the card exceeds HK$150,000, although many cardholders are able to have the annual fee waived even if they fail to meet this threshold – just call and ask!

Combination with the Asia Miles dining programme

If you enjoy a meal at an Asia Miles partner restaurant, you stand to earn even more miles, especially if you dine on a Monday! In addition to the standard HK$6 = 1 AM awarded by Amex for using the card at a Hong Kong dining outlet, the Asia Miles partner restaurant programme will also credit additional miles to your account at the rate of HK$1 = 1 AM on Mondays and HK$2 = 1 AM during the rest of the week. For example, if you dine at a partner restaurant on a Monday and the bill totals HK$600, you stand to earn the following:

- SCB: HK$600/6 = 100 AM

- Dining (Mon): HK$600/1 = 600 AM

- Total: 700 AM

A list of Asia Miles partner restaurants can be found at https://dining.asiamiles.com/en/

Thus the effective earn rate for Monday dining at an Asia Miles partner restaurant is HK$1 = 1.17 AM. At current exchange rates of 1 AUD = 5.36 HKD, that equates to 6.27 AM per 1 AUD.

With earning opportunities like that, who wouldn’t want to move to Hong Kong and apply for the American Express Cathay Pacific Elite Credit Card?

DBS Black Mastercard

Unlike the Cathay Pacific American Express Elite Credit Card and the SCB Asia Miles Mastercard, the DBS Black Mastercard earns DBS$ which can be transferred to Asia Miles, British Airways Executive Club, or Singapore Airlines Krisflyer at a rate of 1,000 miles per DBS$48. DBS is one of the few banks that does not charge a miles conversion fee for this service.

DBS in Singapore has also added Qantas as a transfer partner, so it seems likely that DBS’ Hong Kong cardholders will soon also be able to convert their DBS$ to Qantas Points.

Your earn rate depends on whether your spending is local or overseas, with overseas spending earning miles at a higher rate:

| Category | DBS$ per HK$1 | Miles per HK$1 |

| Local | DBS$2 | HK$6 = 1 mile |

| Overseas | DBS$3 | HK$4 = 1 mile |

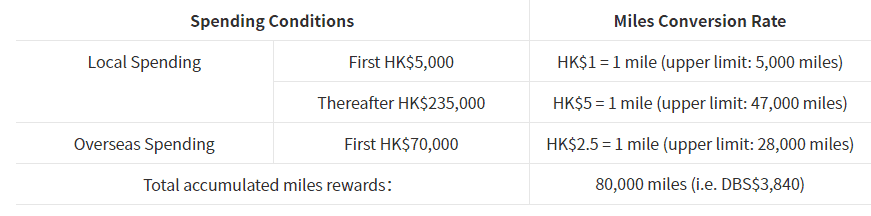

This card comes with a sign-up bonus of up to 80,000 miles:

Other benefits include:

- LoungeKey

- Complimentary newspaper from RELAY at Hong Kong Airport

- Exclusive discount codes for certain online travel booking platforms, e.g. up to 12% off at Expedia and Hotels.com, 7% off at Agoda, 70% off at KKday, and 5% off at Klook

- Free upgrades from Economy to Super Class on the TurboJet ferry from Hong Kong Airport to Macau

- Free return Hong Kong-Macau ferry ticket upon buying 3 regular return tickets

- 10% discount at AMC Pacific Place and Broadway Circuit cinemas

- Discounts at some of Hong Kong’s best restaurants, e.g. 15% at the Conrad Hotel and the JW Marriott, and 20% off at the Le Meridien Cyberport’s restaurants

A full list of offers available to DBS cardholders is here: https://www.dbs.com.hk/personal/YRO/index.html#

Like most Hong Kong credit cards, the DBS Black comes with an annual fee of HK$1,800 that is waived for the first year, although in reality, you need never pay this fee. Once the annual fee hits your statement, simply call DBS and follow the prompts for an annual fee waiver. This is a joyfully easy and automated process that will give you a fee waiver simply by pressing a few buttons on your phone and won’t even require you to speak to anyone. Get this card via Nic’s link here