TLDR; our experts rated Up ($10 free bonus when you use code: FLIGHTHACKS10), Ubank ($30 free on with code C7N1TAZ) & Revolut (Free $15 exclusive Flight Hacks bonus) as the best travel debit cards for 2024.

—

No matter where you’re going or for how long, making use of a good travel debit card is one of the easiest ways to save money overseas. The problem is that amidst the excitement, the importance of selecting the best travel debit card often slips the minds of many Australians until the eleventh hour. Most novice travellers fail to realise their mistake until arriving home with an overstuffed suitcase and card fees that could’ve been easily avoided.

The harsh reality is that banks and airport currency exchange services will often rip you off, despite their claims of ‘zero fees’ or ‘0% commission’. Think about it, how can an exchange booth afford the insane airport rent if they don’t make a cent from running their business?!

The good news is that Australians have a few brilliant options when it comes time to select a travel money card. While the array of choices can be overwhelming, with a little research and planning, you can save a considerable sum just by using the right card!

WATCH: our video comparing 11 of the most popular travel cards in Australia!

In this post:

Global Spending: Travel Debit Card 101

Many amateur travellers will use their day-to-day debit card overseas, simply because it’s easy to use a card that already has your money loaded and ready to go. But before tapping away, it’s important to understand the fees you’ll be in for.

When making international purchases, there are three main fees you should understand;

- International Transaction Rate: Charged when you make a purchase with an overseas merchant, often as a percentage of the total transaction. In Australia, many banks charge a foreign transaction fee of 3% or higher.

- Overseas ATM Withdrawal Fee: Charged for the privilege of withdrawing your own money at an overseas ATM, typically a fixed dollar amount per withdrawal. Sometimes the ATM operator will charge an additional fee for using their ATM. How fun!

- Foreign Exchange Markup: This is where banks are especially sneaky. While you might think you’re getting the real exchange rate, like you’d see searching Google or XE, banks will make up their own rate which includes a hidden fee on top. Of course, you will only be shown the ‘final price’ to hide the fee applied to the real rate.

What About Prepaid Travel-Branded Cards?

If you’ve been looking for the perfect card to use overseas, you would have seen big banks and loyalty schemes offering travel money cards. But just because your day-to-day bank offers a dedicated travel card, it doesn’t mean you should get one. In fact, if a card has the word “travel” as part of its name, RUN AWAY while you still can. That is, unless you like being shafted by some of the richest companies in Australia.

Prepaid options like the Commbank Travel Money Card and Qantas Travel Money Card typically offer a portal where you can preload a foreign currency, before arriving at your destination. While it might sound logical to have your money in the correct currency before payment, the fees involved can be astronomical. Despite the promise of “fee-free load options”, there’s almost always a huge foreign exchange markup when you send Australian Dollars to a prepaid card.

The other downside is that you’re forced to lock-in the exchange rate when loading Australian Dollars. While this is marketed as a perk, it’s also a potential disaster if the exchange rate moves against you, after you’ve transferred your entire spending money across. So, unless you have a crystal ball that predicts when the exchange rate is best, I wouldn’t see it as a benefit myself.

Foreign Exchange Rates: Visa vs Mastercard

Although Visa and Mastercard don’t offer cards themselves, they do have a say in determining the foreign exchange rate you’ll get. While prepaid cards devise their own inflated rates, the best cards, which we will share below, utilise the Visa or Mastercard exchange rate without applying a markup. The difference between the two is almost non-existent, so there is no point in selecting your card based on the payment network.

The table below shows how much Visa and Mastercard offered for 1 AUD as of 27th March 2024. As you can see, the rates are identical, except for JPY where the difference is minuscule anyway.

| Visa | Mastercard | |

|---|---|---|

| USD | 0.66 | 0.66 |

| EUR | 0.60 | 0.60 |

| GBP | 0.52 | 0.52 |

| JPY | 99.23 | 99.26 |

| SGD | 0.88 | 0.88 |

| THB | 23.91 | 23.91 |

| NZD | 1.09 | 1.09 |

| AED | 2.41 | 2.41 |

| CAD | 0.89 | 0.89 |

| HKD | 5.13 | 5.13 |

How Much Can I Save By Using A Good Card?

How much you can save will depend on the fees associated with your day-to-day card, how much you spend and where you spend it. Let’s compare transactions if you were to use the Commbank Travel Money, Qantas Travel Money or Up Debit cards.

Making A €500 Card Purchase

The Commbank Travel Money card charges a flat 3% fee for currency conversion on purchases and withdrawals. Qantas Travel Money claims to have “no fee” for purchases in their marketing material, but their foreign exchange rate adds an insane markup.

As an example, say you paid your 500 Euro hotel bill using one of these cards. Based on our testing (on 27th March 2024), Commbank would charge a $24.92 fee, while Qantas slaps a disgusting $47.13 or 5.67% markup on top of the real exchange rate. Remember – the Qantas card has access to Mastercard’s foreign exchange rates, and if they so pleased, could offer the same true fee-free rate as Up’s Mastercard option.

| Commbank | Qantas | Up | |

|---|---|---|---|

| Exchange Rate | $829.95 | $877.08 | $829.95 |

| Conversion Fee | $24.89 | $0 | $0 |

| TOTAL | $854.84 | $877.08 | $829.95 |

Withdrawing €500 From An ATM

The Commbank Travel Money card charges $3.5 for ATM withdrawals, charged in the currency from which you’re making the withdrawal. Qantas charges a different rate depending on which currency you’re withdrawing, but for Euros, it’s €1.5. Of course, Up doesn’t charge a fee.

As an example, say you need to withdraw 500 Euros from an ATM. The conversion fees are the same as above, but you’d need to pay an additional fee for using the ATM. Keep in mind that the ATM you use could charge its own fee, but this will apply to most cards so it’s the same across the board.

| Commbank | Qantas | Up | |

|---|---|---|---|

| Exchange Rate | $829.95 | $877.08 | $829.95 |

| ATM Withdrawal Fee | $3.5 | $2.63 | $0 |

| Conversion Fee/Markup | $24.89 | $0 | $0 |

| TOTAL | $858.34 | $879.71 | $829.95 |

Our Picks: Best Travel Debit Cards In 2024

Now that you understand how critical it is to utilise a good debit card overseas, it’s time to explore the best options for Australian travellers. Not all banks provide the same features, so be sure to shop around and find a good fit for you. We’d also recommend packing at least one backup card in the event your main card becomes lost or stolen.

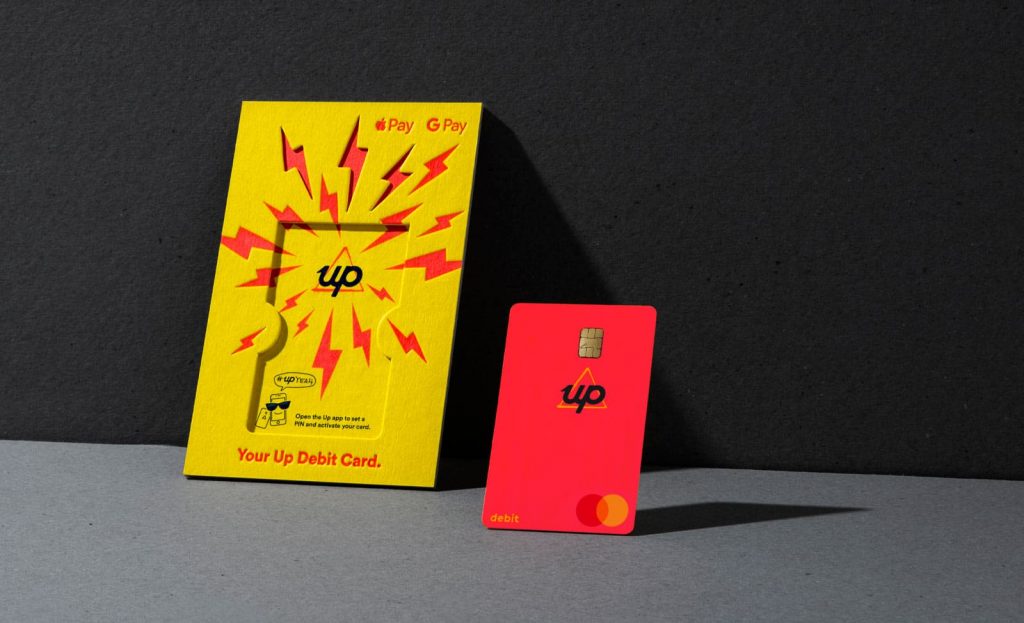

Up Debit Card

- Payment Network: Mastercard

- International Transaction Rate: 0%

- Overseas ATM Fee: $0

- Account Fee: $0

Sign-Up Bonus: $15 – For a limited time, you can receive a $10 welcome bonus for becoming an Upsider! Join using our Up Bank invite code “FLIGHTHACKS10“to score $10 after joining and making 5 transactions on your account.

Up is a digital bank (owned by Bendigo & Adelaide Bank) that proves it’s possible to love your bank. Setup is a breeze, and of course, Up charges absolutely nothing when you use an Up Debit card overseas. As a neobank, Up doesn’t have any physical branches, with everything easily handled from within the best banking app I’ve ever used. It’s super clean by design and packed full of useful features like payment splitting, the ability to detect recurring charges, easy payments to friends by name and detailed spending insights.

Want the full story? Check out our detailed Up Debit Card Review!

T&Cs @ up.com.au/terms

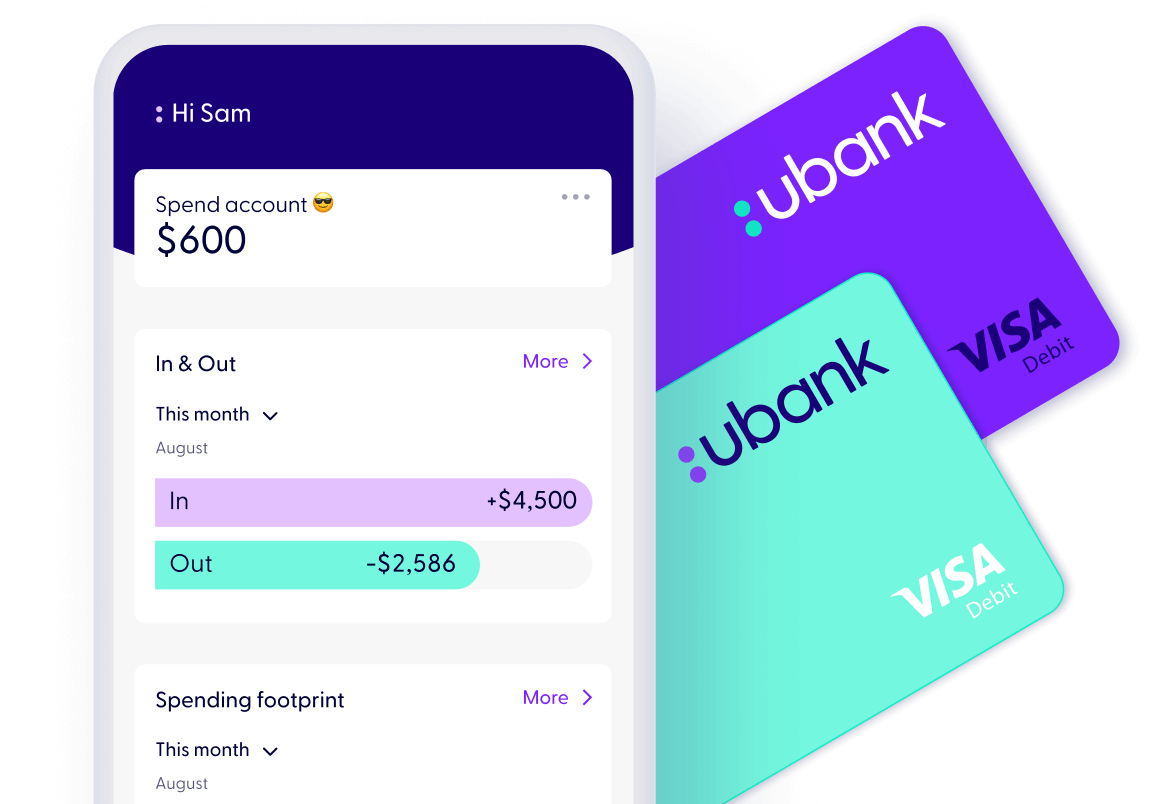

Ubank Debit Card

- Payment Network: Visa

- International Transaction Rate: 0%

- Overseas ATM Fee: $0

- Account Fee: $0

Sign-Up Bonus: $30 – For a limited time, you can use our Ubank referral code C7N1TAZ to score $30 in your new Ubank account after making 5 purchases within 30 days of signup.

Ubank is another digital bank with zero fees for using your connected debit card overseas. While the app isn’t quite as fantastic as Up’s offering, Ubank is still a great option. The upside is that Ubank also offers savings accounts that have consistently given some of the highest interest rates in Australia. Not to mention joining takes just a few minutes and they offer a joint account option.

After more info? Read out our complete Ubank Debit Card Review!

Revolut Australia

- Payment Network: Visa

- International Transaction Rate: 0%

- Overseas ATM Fee: $0 ($350-$1400/m fee-free limit based on plan)

- Account Fee: $0-$24.99/month (based on plan)

Sign-Up Bonus: We’ve partnered with Revolut to offer Flight Hacks readers an exclusive $15 in their new account. Join via this link to score $15 after making 1 transaction within 14 days.

Everything money is accessible with Revolut, from spending on your debit card to investing in stocks and EFTs, crypto, gold and silver. From a travel perspective, Revolut offers minimal fees and the ability to preload your card with one of several currencies or spend using AUD at the current exchange rate. SmartDelay also offers complimentary airport lounge passes for you and up to 3 friends when your flight is delayed by more than an hour.

Revolut is also great for those travelling with anyone aged 6 to 17, thanks to the option for parents and legal guardians to create a linked account for their children. The main account holder gains access to a bunch of insights and controls, while under 18’s can spend their own funds with the same money-saving perks as the main account holder.

In Australia, Revolut offers users a free Standard plan, in addition to increased perks on a Premium ($9.99/month) or Metal ($24.99/month) membership. While also including a solid reinforced steel card, the Metal option offers monthly benefits like three fee-free international payments, unlimited fee-free weekday currency exchange and fee-free ATM withdrawals up to $1,400. Not willing to pay for a full year? You can always upgrade for your trip and cancel the plan once you return home.

Ready to learn more? View our Revolut Australia guide!

Macquarie Transaction Account

- Payment Network: Mastercard

- International Transaction Rate: 0%

- Overseas ATM Fee: $0

- Account Fee: $0

If you’re after a debit card for travel from a big bank, but not quite big enough to rip you off, Macquarie has you covered. Although the app and online banking portal are in desperate need of an update, the product itself is hard to fault.

Macquarie also offers a few perks like a luggage return service that will pester the airline on your behalf, if they mishandle your checked baggage. There is a small service fee for this, but if your bag is not returned within 96 hours, you’ll receive a $100 payout per lost bag. In addition, cardholders have access to a concierge service, card purchase cover and wallet guard cover. Considering this is just a debit card, those are some nice benefits to have up your sleeve.

Deposits made on a Macquarie Transaction Account can also earn interest, up to 4.75% p.a (as of March 2024).

HSBC Everyday Global Account

- Payment Network: Visa

- International Transaction Rate: 0%

- Overseas ATM Fee: $0

- Account Fee: $0

HSBC’s worldwide reach makes its Everyday Global Account an attractive offering. If you need to make an ATM withdrawal, you can visit a HSBC ATM to guarantee zero withdrawal fees around the world! The exception is in Argentina, France, Greece, Mexico, Malta and Turkey where there is a small fee.

There’s an option to buy and transfer between ten currencies (AUD, USD, GBP, EUR, HKD, CAD, JPY, NZD, SGD, CNY), although HSBC does hide a foreign markup here by using their own HSBC Daily Exchange Rate. For the best rate, simply load AUD onto the debit card before spending overseas, where the Visa exchange rate will apply with zero markup.

Plus, if you deposit at least $2,000 into your Everyday Global Account before the last business day of each calendar month, you can earn 2% cashback up to $50 per month. You’ll earn cashback on eligible purchases with Australian merchants under $100, when you spend via payWave, Apple Pay or Google Pay. There are a few transactions that won’t be eligible, including public transport, car parking and vending machines.

Wise Multi-Currency Account

- Payment Network: Mastercard

- International Transaction Rate: 0%

- Overseas ATM Fee up to 350 AUD/month: $0

- Overseas ATM Fee over 350 AUD/month: $1.50 ($1.50+1.75% for 3+ withdrawals)

- Card Load Fee: 0% to 2% depending on currency

- Account Fee: $0

- Physical Card Fee: $10

Wise (previously Transferwise) used to offer one of the best cards out there, until moving to an overly complex fee structure that feels very ‘banky’. That includes a $10 fee if you’d like a physical debit card, and high fees for withdrawing money overseas, once you go over the small monthly allowance. We do appreciate that those fees aren’t hidden, and you’ll see the exact exchange rate and the Wise fee applied before completing a transfer.

Because they still offer a real mid-market rate and are one of the best options for transferring foreign currency between friends, Wise still makes our list. They also offer a cool virtual card feature, that can be useful for pesky subscriptions or transactions where you want to cancel your card afterwards, without the consequences.

All up, Wise is a solid option if you need to make a bunch of transfers, but one to avoid if you plan on using overseas ATMs.

Keen on Wise? Why not read our Wise Australia review!

Honourable Mentions – Best Travel Debit Card

We’d be here all day if we reviewed every Aussie debit card with zero foreign transaction fees and fee-free overseas ATM withdrawals. Our guide above covers the best options for most travellers, but there are a few cards that deserve an honourable mention.

- Bankwest Easy Transaction Account

- ME Bank SpendME Transaction Account

- Suncorp Everyday Options Account

Australia’s Worst Travel Debit Cards Revealed

Many big banks and frequent flyer schemes market travel money cards, but often, these come packed with hidden fees that make them completely useless. Unless you enjoy giving away your money (in which case you should send it directly to us), here are some popular options to avoid;

Qantas Travel Money

- Payment Network: Mastercard

- International Transaction Rate: “free” with hidden markup

- Overseas ATM Fee: approx. $1.95 – $3.00 (varies with currency)

- Card Load Fee: 0.5%

- Account Fee: $0

Qantas Travel Money is possibly the worst travel card out there. While advertising zero exchange fees, the ridiculously expensive “Qantas Travel Money Daily Rate” is used when you transfer funds between currencies or make a purchase. For example, in our €500 spend test above, using the Qantas Travel Money would cost a whopping $47.13 more than using a fee-free Up debit card. That’s a hidden markup of 5.67% – and Qantas will still charge an ATM fee!

For international purchases, you can earn 1.5 Qantas Points for every $1 equivalent spent in foreign currency. Even though we love Qantas Points, the insane nearly 6% markup is a complete ripoff and not worth paying to earn points.

Commbank Travel Money

- Payment Network: Visa

- Foreign Exchange Rate: 3%

- Overseas ATM Fee: A$3.50

- Card Load Fee: “free” with hidden markup

- Account Fee: $0

Despite its widespread usage, the Commbank Travel Money Card is another terrible option for overseas spending. That popularity comes from Commbank’s extensive customer base within Australia, with many travellers sticking with the one bank, instead of exploring better alternatives. But the thing is, each of the no-fee options listed above can be funded instantly from your existing Commbank account, so there is no upside to using Commbank Travel Money.

While the card itself is free to hold, there’s a 3% conversion fee applied with each transaction made in a different currency. Additionally, you’ll pay $3.50 for every overseas ATM withdrawal. Commbamk becomes an even worse option once you realise how misleading their advertising of “no reload fees” is. While technically true, Commbank makes up its own exchange rate for card loads, which is approximately 4.4% worse than the Visa rate (at the time of writing). Essentially, this translates to a 4.4% fee when loading foreign currency onto the Commbank Travel Money Card.

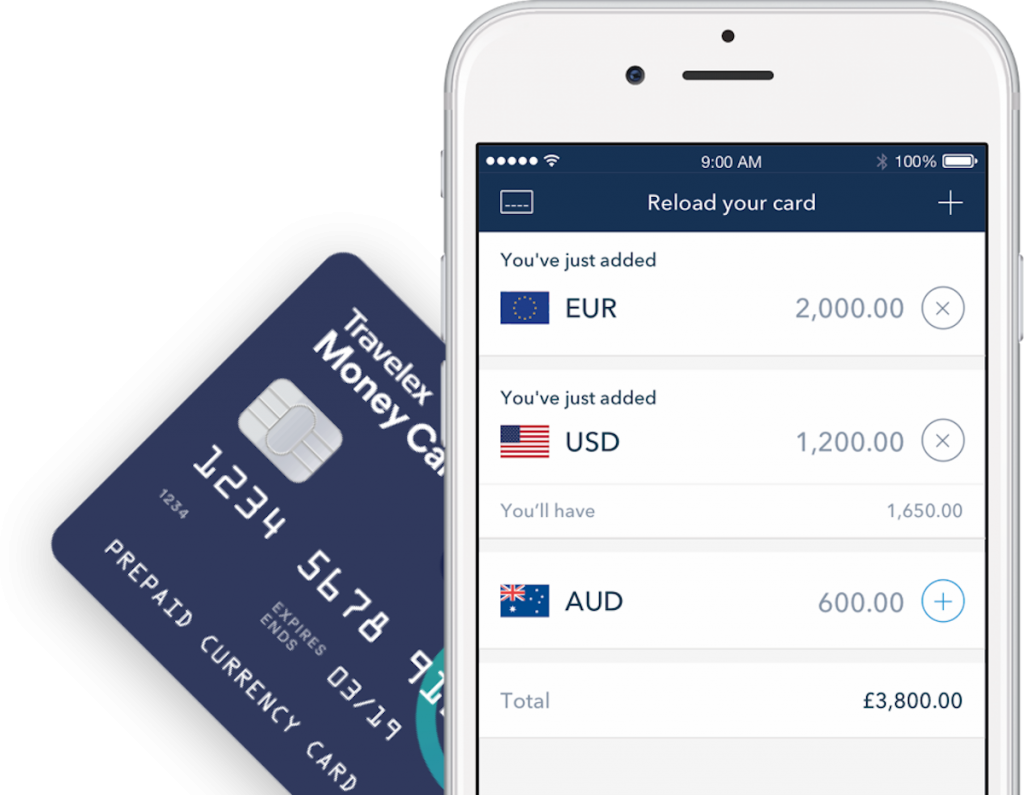

Travelex Money Card

- Payment Network: Mastercard

- International Transaction Rate: “free” with hidden markup

- Overseas ATM Fee: $5

- In-Store Load Fee: 1.1% or $15 (whichever is higher)

- Online Load Fee: $0

- Account Fee: $0

- Inactivity Fee: $4 monthly (once your card is inactive for 12 months)

- Closure Fee: $10

You only have to read the endless list of fees to realise the Travelex Money Card is about as deceptive as it gets. Travelex does offer unlimited fee-free overseas ATM withdrawals, which is nice, but once you realise the other fees that are adding up and decide to close your account – oh wait, there’s a fee for that! You’ll also need to pay Travelex a monthly fee for the privilege of NOT using your card, once it becomes inactive for 12 months.

Travelex’s PDS says their foreign exchange rate is “set and determined by Mastercard”. What they don’t openly admit is that there is a hidden markup, which is easily spotted when you compare the Travelex exchange rate to that offered by Mastercard.

NAB Visa Debit

- Payment Network: Visa

- International Transaction Rate: 3%

- Overseas ATM Fee: $5

- Account Fee: $0

When NAB acquired Citibank in Australia, they removed one of the best big-bank travel cards available (the Citibank Saver Plus) and directed new customers to the NAB Visa Debit Card. As far as international spending, this new option is an absolute waste of plastic.

Instead of guaranteed free transitions at Citibank’s enormous overseas ATM network, you’ll get charged $5 at every single overseas ATM – yay! There’s also a juicy 3% international transaction rate, so you’ll pay a fee regardless of how you spend your money overseas.

ANZ Plus Transaction Account

- Payment Network: Visa

- International Transaction Rate: 3%

- Overseas ATM Fee: $5

- Account Fee: $0

ANZ Plus is ANZ’s new digital banking service that comes with a transaction account and a linked savings account. ANZ and ANZ Plus are like two peas in a pod, except one pea decided to get a snazzy makeover and call itself ‘Plus’. It’s as if ANZ woke up one day and thought, ‘You know what this bank needs? Another version of itself that’s slightly better but nearly identical’.

In all honesty, ANZ Plus is a solid product to use within Australia, with a cool banking app, competitive interest rate and useful insights to help you save money. But the good news stops there, with ANZ’s better version of itself keeping the fees for international use. You’ll pay $5 for overseas ATM withdrawals and a 3% fee on foreign transactions.

Westpac Travel Money

- Payment Network: Mastercard

- Foreign Exchange Rate: 0%

- Overseas ATM Fee: approx. $1.50-$3.50 (varies with currency)

- Card Load Fee: “free” with hidden markup

- Account Fee: $0

As far as big-bank travel cards go, Westpac’s Travel Money Card (also known as the Westpac Worldwide Wallett) isn’t quite as terrible as the rest. Although there are still hidden fees when you load your card, as well as when you withdraw money from an overseas ATM. The only reason we say Westpac’s travel card isn’t as awful is that they use the Mastercard rate when spending in currencies you don’t have loaded, without a markup. But overall, this is still one to avoid.

ING Orange Everyday

- Payment Network: Visa

- International Transaction Rate: 3%

- Overseas ATM Fee: $5

- Account Fee: $0

We used to love ING’s Orange Everyday card for overseas spending. But as the card became more and more popular, ING decided to capitalise by introducing international transaction fees, and then raise them even higher.

You can get all international transaction fees rebated, but you’ll need to make at least 5 eligible purchases and deposit at least $1,000 to one of your personal ING accounts every month. The same can be said for overseas ATM withdrawals, of which the first five fees can be rebated provided you make at least 5 eligible purchases and deposit at least $2,000 to one of your personal ING accounts every month.

Because of this unnecessary step to qualify for zero fees, we no longer recommend the ING Orange Everyday for travel.

Summing Up: Our Expert Tips

With so many fee-free travel debit cards available, there’s no reason why you should pay banks every time you need to spend money overseas. With a little research into a travel debit card that suits you, it’s pretty easy to save thousands in bank fees.

Alongside a fee-free card, be sure to employ these tips when spending overseas;

- Never pay in Australian Dollars: It’s one of the biggest travel card scams out there as merchants will make up their own terrible foreign exchange rate, and then charge a fee on top, to convert the local price to Australian dollars. You’ve probably paid with an EFTPOS machine or used an ATM that asks if you want to pay in AUD instead of the local currency. While it might sound like you’re getting a better deal with Australian dollars, this is almost never the case. Be sure to pay in the local currency, using a fee-free card above.

- Check for fees applied by the ATM: While any good debit card will offer zero ATM fees, that doesn’t stop ATM operators from charging their own fees. The machine should tell you before charging a fee.

- Be prepared with multiple card options: In case your card stops working, is stolen or becomes lost it’s a good idea to have a backup card.

- Use your travel debit card for online purchases: Avoid foreign transaction fees when shopping online with overseas merchants by using your card for travel.

Travel Debit Cards FAQs

I am going to visit [insert destination] – which card should I use?

The cards we recommend above are great for spending overseas. Be sure to consider the features important to you (eg. no ATM fees) when selecting a card for travel.

Which card uses the best currency conversion rates?

We have compared Visa and Mastercard’s spot rates above – there is little difference. Be sure to use a card that uses these spot rates, without applying a markup.

Can I use any Australian debit card overseas?

Nearly all Australian debit cards with a Visa or Mastercard symbol will work around the globe. There are a few exceptions, for example, many cards are currently blocked within Russia and other regions of conflict.

Should I tell my bank where I’m going?

It’s not something we regularly do, but it doesn’t hurt to notify your bank that you’ll be travelling overseas to avoid international purchases being mistaken for suspicious activity.

Why shouldn’t I transfer a bunch of AUD to the currency I will be spending?

It’s a bad idea to convert money ahead of your trip unless you have a crystal ball and know which way the exchange rate will move. If the exchange rate changes in your favour, you could lose out big time. The most accurate rate is achieved with a fee-free card loaded with AUD, using the payment provider’s spot rate

Can I use any frequent flyer credit card overseas?

While your Australian credit card will work overseas, most will charge a 3% fee when spending in a foreign currency. If your card earns a high number of points per dollar, that fee could be worth paying. It just depends how many points you’re going to get, and what fee you’ll be charged.

Which travel debit card is best for international travel?

The best travel debit card is going to have low or no international transaction fees, as well as the features that best suit you. Be sure to check out the best cards listed in this guide.