It’s no secret that frequent flyer points are your ticket to flying in business or first class for the price of economy. It’s what we do at Flight Hacks, and we aim to inspire you to fly the same way!

It’s a longstanding myth that to earn frequent flyer points you need to fly a lot. This couldn’t be further from the truth!

These days the easiest and fastest way to earn those frequent flyer points is by taking advantage of the many frequent flyer credit card deals in the market. But which cards are the best value and will get you to the front of the plane faster?

We’ve compiled our top 4 card deals on right now which can earn you between 100,000 to 120,000 frequent flyer points. To put this in perspective, that’s more than enough points to take off in business and even first class!

ANZ Frequent Flyer Black

Get: 120,000 Bonus Qantas Points

Right now, ANZ is offering a large sign-up bonus of 120,000 (an increase from 100,000 previously offered) Qantas Frequent Flyer Points on their top tier black Visa card. If that’s not enough, there’s $275 back to your card (increased from $200 previously offered!) and two Qantas lounge passes on the table when you are approved and meet the minimum spend and terms and conditions.

Here are the benefits:

- 120,000 bonus Qantas Points and $275 back to your new ANZ Frequent Flyer Black. When you spend $4,000 on eligible purchases in the first 3 months from approval.

- 2 Qantas Club lounge access passes each year you hold the card

- $275 back to your new card

- Discounted Qantas Club membership for the first year

- Unlimited international lounge access through Véloce World

- Complimentary Qantas Frequent Flyer membership, saving you $99.50

- 24/7 Concierge service to assist with bookings and reservations

- Earn 1 Qantas Frequent Flyer Point per $1 spent on eligible purchases, capped at $7,500 after which the earn rate reduces to 0.5 Qantas Points per $1 spent

Click here to get this deal online via ANZ

Qantas American Express Ultimate

Get: 100,000 Bonus Qantas Points

The Qantas American Express Ultimate is as the name suggests, the ultimate Qantas Points credit card. Qantas American Express Ultimate 55,000 bonus Qantas Points when you apply online, are approved and spend $3,000 on your new Card within the first 3 months.

(New Card Members only.)

Here are the benefits:

- Enjoy 2 complimentary Qantas lounge invitations.

- Receive 55,000 bonus Qantas Points when you apply online, are approved and spend $3,000 on your new Card within the first 3 months. Offer available to new American Express Card Members only, as well as Bank-issued American Express companion cardholders

- Earn 1.25 Qantas Points per $1 spent on eligible purchases.

- $450 Qantas Travel Credit each year. Use your Qantas Travel Credit for eligible international or domestic Qantas flights when you book and pay online at American Express Travel

- Enjoy complimentary access up to two entries per year to the American Express Lounge at Sydney and Melbourne International Airports

- Enjoy two complimentary Qantas Club lounge invitations each year after your first Card spend on selected Qantas products and services

- Complimentary Qantas Wine Premium Membership

- 0% p.a. on balance transfers for the first 12 months — A one-off credit plan establishment fee of 1% and T&Cs apply.

- Complimentary domestic and international travel insurance when you pay for travel using your Card

Click here to get this deal online via American Express

NAB Qantas Rewards Signature

Get Up To: 130,000 Bonus Qantas Points

Earn up to 130,000 Bonus Points on a new NAB Qantas Rewards Signature Card when you keep your card open for over 12 months. Minimum $3,000 spend in first 60 days.

To be eligible for the 130,000 Bonus points offer, you must apply for a new personal NAB Qantas Rewards Signature Card, be approved, and spend $3,000 on everyday purchases within 60 days of opening your account.

Points will be awarded on a tiered basis – 100,000 bonus points when you spend $3,000 on everyday purchases in the first 60 days (credited to your points balance within 3 months of meeting the spend criteria) and 30,000 bonus points after 12 months (credited to your points balance within the 13th month). T&Cs, spend criteria, eligibility criteria, fees and charges apply.

Here are the benefits:

- Earn up to 130,000 Bonus Points on a new NAB Qantas Rewards Signature Card when you keep your card open for over 12 months. Minimum $3,000 spend in first 60 days.

- Earn Rate: 1 Qantas point per $1 up to $5,000 per month, then 0.5 points per $1 capped at $20,000 per month.

- Qantas Points Booster: Earn 2 points per $1 when spending with Qantas.

- Annual Fee: $295 reduced annual fee for the first year ($395 each year after that)

Click here to get this deal online via NAB

American Express Qantas Business Rewards Card

Get: Up to 140,000 Bonus Qantas Points

The American Express Qantas Business Rewards Card now comes with 120,000 bonus Qantas Points, plus an additional 20,000 for a limited time only. Apply by 3rd May 2020 and spend $3,000 in first two months to get 120,000 bonus Qantas Points. New Card Members only. Plus, for a limited time earn an additional 20,000 bonus Qantas Points when you earn 1 Point in first 30 days of Card Membership. New QBR Program Members only.

The American Express Qantas Business Rewards card is aimed at small to medium business owners who are looking to earn points in the Qantas Business Rewards program.

Click here to get this deal online via American Express

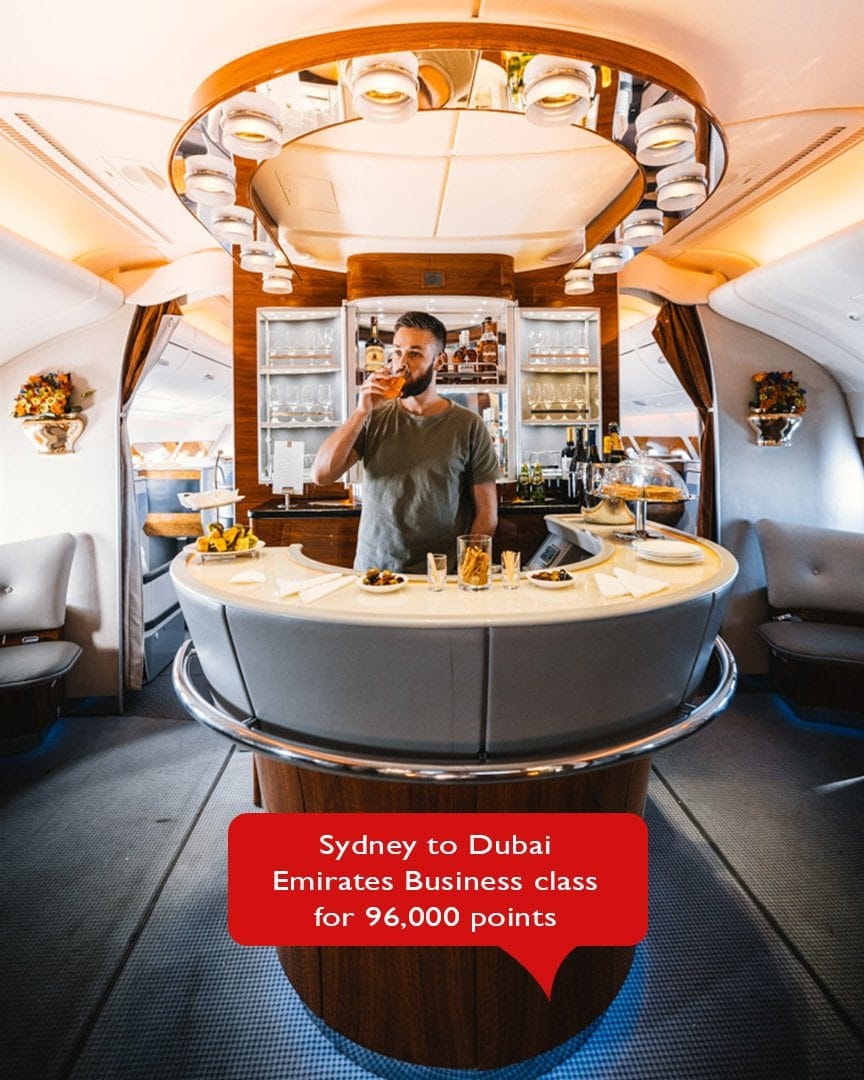

Where can you go with these points?

Here are a few ideas on how you can spend your frequent flyer points! Note that these prices are for outright ticket redemptions in business or first class; this is when you get the best value compared to upgrading.