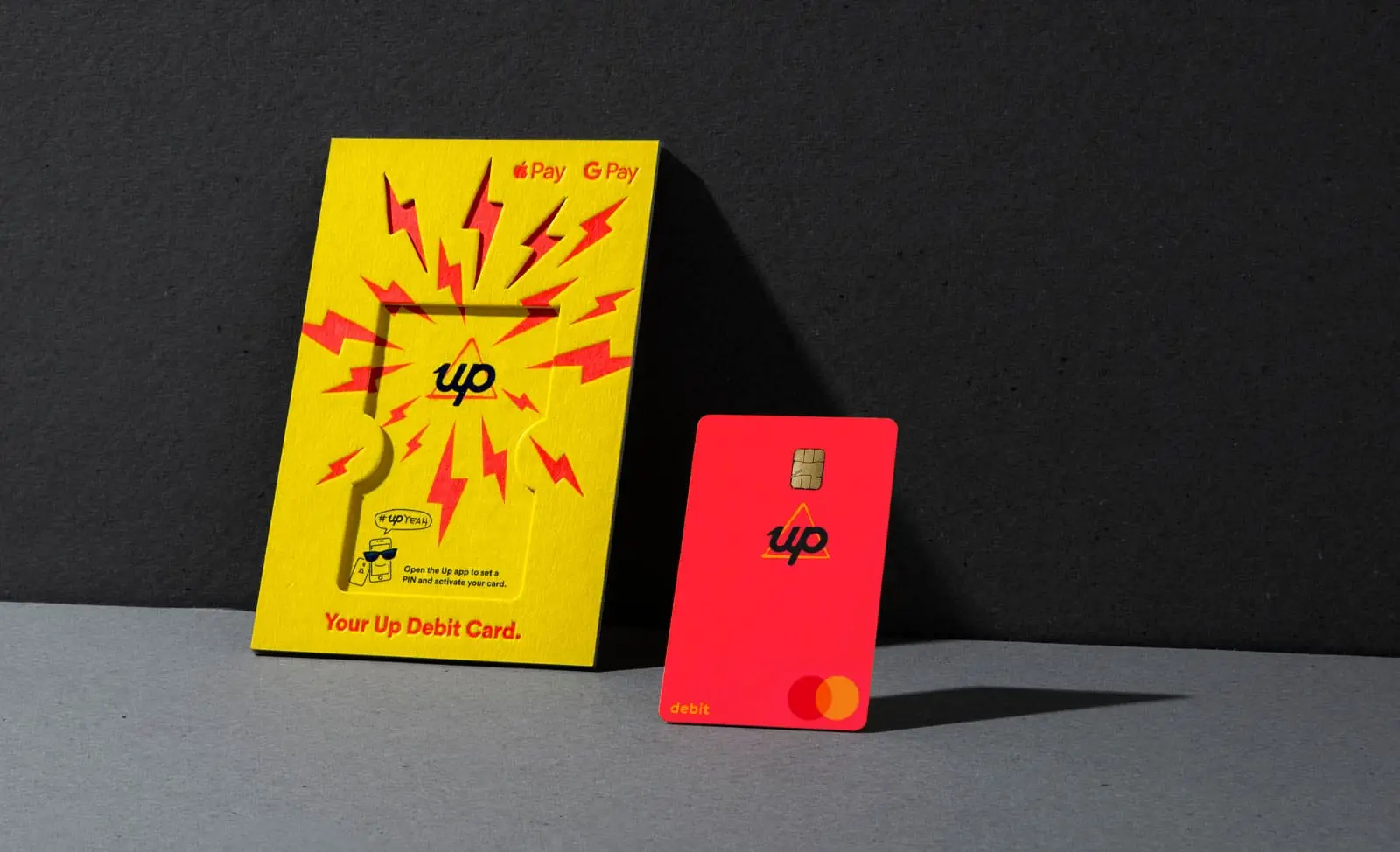

Up Debit Card — $10 Sign Up Bonus

The Up Bank debit card offers 0% conversion fees overseas as well as a $10 sign up bonus.

Up card is a digital bank with a physical debit card designed to help you organise your money and simplify your banking life. As one of Australia’s first “neobanks”, Up offers a free account and free debit card with no fees.

Signing up for an Up account takes minutes and thanks to Apple and Google Pay, you can start using your account right away. Up bank users enjoy 0% foreign currency conversion fees and $0 fees for ATM withdrawals both in Australia and overseas.

Flight Hacks Promo: sign up with code "FLIGHTHACKS10" and get $10 cash added to your account when you complete 5 transactions

T&Cs @ up.com.au/terms

Up Bank Invite Code: Get $10 cash in your account!

Sign up for the free Up card and bank account using our Up Bank invite code (FLIGHTHACKS10) and you will receive $10 account credit. Up is a debit card/bank account so there are no credit checks and income requirements.

Apply Now Get $10 - It's Free! With Our Up Bank Invite Code.

So what’s a Neobank?

Neobanks are simply banks which are completely digital. Although the word bank is generally associated with long queues, poor customer service and countless fees, neobanks promise to be different. They don’t even have physical branches!

What they do provide is all the banking services you need from the convenience of a smartphone app. They vow to deliver app-based banking that is easy to use and beautifully designed, with the ability to quickly track your spending while also delivering an excellent customer experience.

Is Up Safe?

At first, you may be apprehensive about the idea of a fully digital bank. Although, it is important to note that neobanks are regulated by the same authorities as traditional banks – the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investment Commission (ASIC). Plus, just like traditional banks, deposits of up to $250,000 per person are protected by the Financial Claims Scheme (FCS). Plus, Up accounts offer added reassurance in being backed by Bendigo Bank.

Up Account Features

The Up Bank account and debit card comes with all the features you would expect from your everyday bank plus more!

- No Fees: All the basics of a debit card with zero card, account or ATM fees (ATM providers may charge a fee – watch out for that!)

- Detailed Transaction History: Tells you who you paid, including the company name and often a logo, when you paid down to the minute and the suburb where the transaction was made

- Monthly Spending Insights: Details what, when and where you spent automatically grouped into simple categories

- Account Funding: Instant bank transfers using PayID or your Up BSB and Account Number

- Configure Card: Instant control of on whether your card can be used for ATM withdrawals, contactless payments, in-store/online purchases and International/Domestic spending

- Contactless Payments: Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin Pay

- Roundup Savers: When enabled each transaction is automatically rounded to the nearest dollar, with the amount rounded put in a savings account

Up Is Great For Travel

While traditional banks will charge in excess of 3%, Up has zero currency conversion fees and zero international ATM withdrawal fees (although the ATM provider may charge a fee). To work out the currency conversion rate, Up uses Mastercard’s daily standard FX rate, without applying any markup.

4.35%% p.a. Interest Rate*

Up boasts one of the best savings account interest rates of 4.35%% p.a.

Eligibility Criteria

To be eligible for the Up Bank account and debit card, you will need to be able to say yes to the following:

- Account type: Must be an individual

- Residency: Resident or citizen of Australia

- Minimum Age: 16

Is Up right for you?

Up is setting a new benchmark for what a banking app should be, and truly showing just how far behind the big four are. With useful spending insights, multiple payment options, a savings interest rate that ranks among the best in Australia, there is a lot to like about Up. Not to mention it is quick and easy to join, you can even start purchasing with your preferred digital wallet straight away.

Related posts