Wise Australia Review - Save Big On International Money Transfers

Discover smarter international banking with Wise Australia: low fees, competitive rates, and seamless transfers.

For frequent international travellers or those who often send money overseas, exchanging currencies can become a nightmare. Oftentimes, we lose out to the banks who offer fictional exchange rates and a considerable serving of fees simply because they can.

Introducing Wise, a currency exchange service who offer true mid-market rates.

What is Wise?

Wise, formerly known as TransferWise is an online money transfer service that offers a fast and cheap alternative to send money abroad. In fact, they claim to be up to eight times cheaper than banks!

Wise is committed to providing transparent money transfers, allowing people to transfer currency at the lowest possible exchange rate.

How does Wise work?

Wise was launched in 2011 after two friends from Estonia, Taavet Hinrikus and Kristo Käärmann, came up with an ingenious way to transfer funds overseas.

Before Wise, the friends were living in London. Taavet was paid in euros, and Kristo was paid in Pounds. Taavet needed Pounds to pay the bills, and Kristo needed Euros to pay his mortgage back in Estonia. So, instead of transferring their hard-earned cash at the bank, the pair would look up the actual exchange rate and transfer their money accordingly. Both received their currency almost instantly, without paying any fees.

Today, Wise works in a similar way. Put simply, your money is converted into your chosen currency and then matched with someone else who wants to transfer in the opposite direction. Then, Wise ‘swap’ each person’s money.

In the real world, it isn’t that simple as a perfect pair won’t always be made, but Wise will do all the heavy lifting for you.

Is Wise safe?

In Australia, Wise is regulated by the Australian Securities and Investments Commission (ASIC), the same group who regulate Australian banks. The company is also registered as a money remitter with Australia’s Financial Intelligence Unit (AUSTRAC) and has an Australian Financial License (456295).

Wise is also regulated, monitored or approved by the following countries:

- Belgium

- Canada

- Hong Kong

- India

- Japan

- Malaysia

- New Zealand

- Singapore

- United Kingdom

- United States

- United Arab Emirates

Find out more on Wise’s website.

As far as online security, TransferWise encrypts your data and uses Two-Factor Authentication (2FA) to protect your personal data from fraud and theft.

Wise currencies

You can use Wise to convert money between 50+ currencies, add money to your account in 18 currencies and receive money from other people in 7 currencies. While the full list can be found on Wise’s website, below are some of the more popular options.

Wise fees

Although Wise doesn’t add a margin to their exchange rates, they do charge a small fee for your transfer. This makes it easy to see exactly what you will be paying. You can even get a transfer quote without a Wise account.

When you request an exchange, you can expect to be charged both a card and service fee.

Card Fee: Charged when you pay for your transfer using your card (pay via a bank transfer to skip this fee).

Service Fee: Comprises a fixed fee and a percentage of the amount you transfer to cover what it costs Wise to send your money, plus a small margin.

Wise Exchange Rates

Wise is one of few currency exchange services that offer customers the real mid-market rate. This is the rate that banks use to trade between themselves, and the same one you would see on Google or XE. It’s the actual exchange rate at that

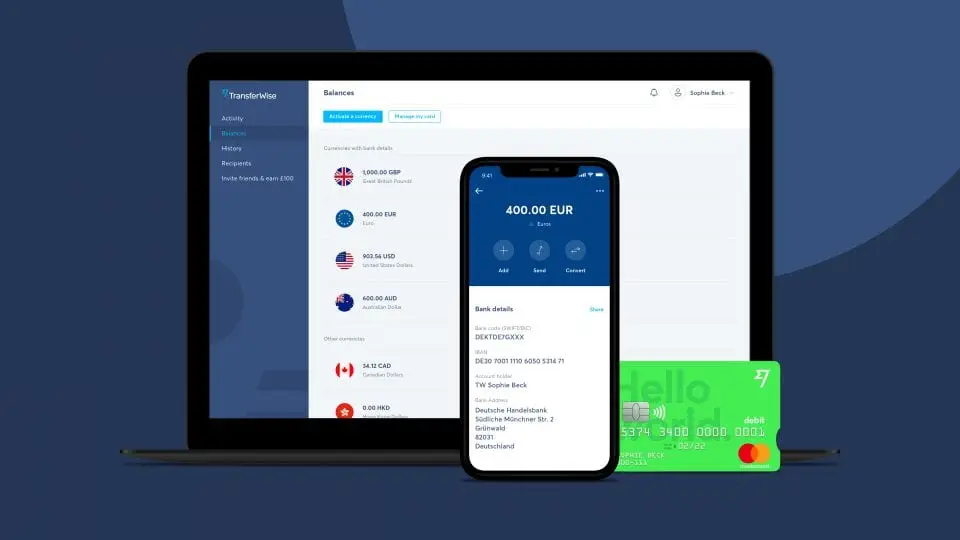

Wise Borderless Account

The Wise Borderless Account is an online multi-currency bank account that comes with a bright green debit card. As well as being able to hold and switch between 40+ currencies, Wise boasts their Borderless Account is 10x cheaper than leading Australian banks.

Plus, local bank account details in the US, UK, EU, Australia and New Zealand mean you can send and receive money just like a personal bank account in those countries.

Not to mention the Wise Borderless Account comes with no annual fees and no minimum balances, making it the ideal companion for international travellers!

How to join Wise

Joining Wise (Called TransferWise previously) is super easy. Here’s how:

Step 1: Click “Register” in the top right-hand corner.

Step 2: Select whether you would like a personal or business account, then enter your email and create a password.

Step 3: Check your email for a link to verify your email address, click this and you are ready to go!

Summing up

Wise can be an excellent way to transfer money abroad. Easy to use and brilliantly transparent, it really is a good alternative for those looking for the best value transfers.

Although it’s always best to compare your options, Wise will often come out on top thanks to their true mid-market rates and little fees.

Related posts