Revolut Australia Review - Best Travel Card?

Revolut is a digital bank that was launched in 2015 and has since taken the world by storm.

Revolut is a digital bank that was launched in 2015 and has since taken the world by storm, with operations in over 30 countries and more than 35+ million users worldwide. Since 2019, Revolut has been available in Australia, offering a range of physical and virtual debit cards for Aussie users.

Tip: Sign up for a free Revolut account via this link and receive a free $15 account credit when you use your card to make a purchase (Note: you need to make a transaction of at least $1 within 14 days of opening your account!).

Bonus: Check out our latest video where we compared 11 Australian travel debit cards including Revolut Visa!

What exactly is Revolut?

The Revolut app offers a range of products, including fiat, stock, and cryptocurrency options.

As a digital bank, Revolut provides users with a BSB and account number to send and receive funds into their Revolut account. One of the main benefits of Revolut is its use as a travel debit card, which is free to use and offers the best exchange rates on the market.

In addition to physical debit cards, Revolut also offers virtual Visa or Mastercard debit cards for added online security. These virtual cards can be generated an unlimited number of times and used for online shopping or subscription services, and then easily removed to disable any future charges. Revolut even has a feature for one-time use virtual cards, which are particularly useful for free trial periods or when purchasing from untrusted websites.

Is Revolut Free?

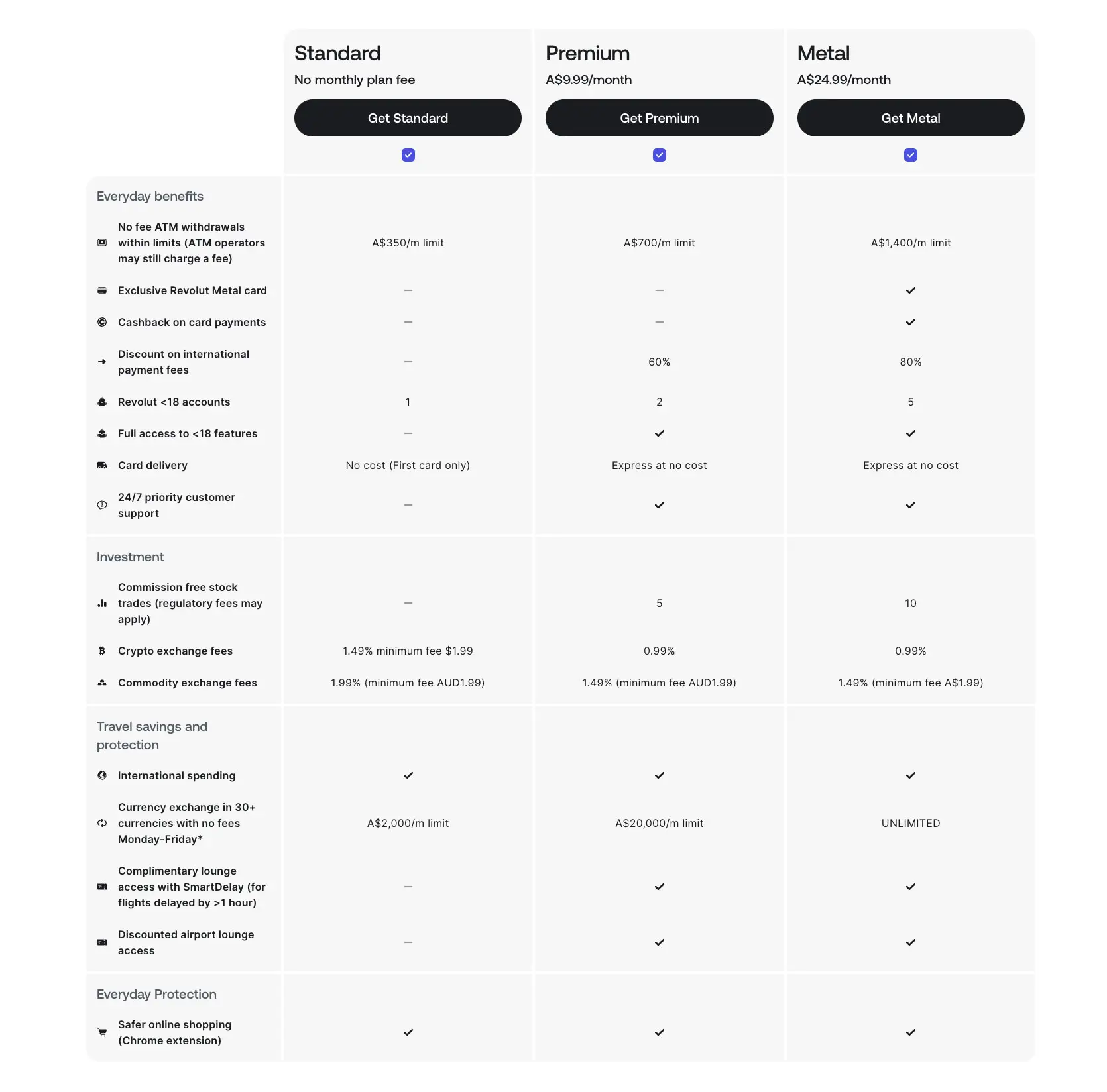

Yes, Revolut is free to use. When signing up, users have the option to choose the free “Standard” account or one of the premium subscription plans, which come with additional features.

In Australia, there are three Revolut plans available: the free Standard plan, the Premium plan at $10.99 per month, and the Metal plan at $24.99 per month.

Paying members can choose to pay monthly or opt for an annual plan at a discounted price. It’s also worth noting that users can subscribe and unsubscribe from premium plans at any time.

Revolut Fees

There aren’t many Revolut fees you need to watch out for but one thing to keep in mind is the ATM withdrawal fee which is charged when you go over your included allowance:

- ATM withdrawals over the Standard ATM Withdrawal Allowance will incur a fee of 2% of the value of the ATM withdrawal

- THB and UAH currency conversions: 1.0% (all other currencies: 0%)

- Buying Cryptocurrencies: A$1.99 for exchanges up to A$133.56 or 1.49% of the value of the exchange, for exchanges over A$133.56

- Buying Precious Metals: A$1.99 for exchanges up to A$100 or 1.99% of the value of the exchange, for exchanges over A$100

- Loading your account with a debit card in Australia: 0%

- Loading your account with a credit card in Australia: up to 1%

- Loading your account with a foreign credit card: up to 2%

Any other fees that might occur are always displayed in the app, up front when/if they will apply to you.

Here is a complete comparison of all the Revolut features:

As you can see, the key differences lie in the amount of fee-free ATM withdrawals you can do using your Revolut card and the fee-free international money transfers. There are also some minor fee reductions for crypto purchases and a higher currency exchange limit, but I don’t see these as all that important.

I think the primary decision maker for people will be the Premium vs Metal plans, and which one is worth it.

Revolut Premium vs Metal – is it worth it?

For the premium plans, it all comes down to how you use your card and, more importantly, how often you use the features!

The key differences between Premium and Metal are the limits on ATM withdrawals, fee-free International money transfers, sub-accounts for minors and the limit on foreign currency conversion.

The cash-back option is the one feature difference that isn’t available to Premium members but is exclusive to Metal. Metal members get up to 1% cash back which can be rather lucrative! The Revolut cashback is great instead of a rewards program where you earn 0.1% on every transaction in Australia and 1% on overseas card purchases (keep in mind, ATM withdrawals etc., don’t earn cash back). On top of that, the other superficial benefit is that you get a rather cool-looking card in Metal, hence the name!

I think for those that travel a lot, Revolut Metal can make sense if you use it as the primary payment method.

Revolut for <18’s?

Revolt is one of the few fintech apps in Australia that has an option for younger members. Parents can issue cards and accounts to their kids under 1 main account. This is designed for adolescents from 6 to 17 years of age. As a <18 account holder, they will be able to manage and spend their own money and have access to their own card and account; of course, as a parent or legal guardian, you will have ultimate control.

This is ideal for parents looking to give their kids fee-free access to their money which can be handy for overseas trips where otherwise they would be slugged with a 3% exchange fee on any product from the big banks.

Revolut Standard gets 1 <18 account, Revolut Premium gets 2, and those with Revolut Metal get access to 5 extra <18 accounts.

Loading Money To Your Revolut Account

Adding money to your Revolut account is very easy, and there are multiple methods; bank transfer is pretty much instant and free, but you can also use your debit or Visa/Mastercard to top up your balance for a small fee (this is calculated when you enter your card details).

You can even set automated top-up features when your Revolut account balance goes below a certain number specified by you.

How about Apple Pay & Google Pay?

Of course, you don’t need a physical card; Revolut plays nice with digital wallets such as Apple or Google Pay.

What about foreign exchange fees?

So far, Revolut is the cheapest money transfer service I’ve found, even compared to Wise! And while there are some limits on the free standard account, for those that send money to family and friends overseas, the premium or metal account will do so with low fees and at an excellent exchange rate.

Is Revolut the perfect travel debit card for Australians?

In short, yes! Especially if you have access to the premium account. However, if you rely on a lot of ATM cash withdrawals, there are better free options, such as Ubank and Up; check out our guide on the best travel debit cards here.

Revolut doesn’t charge foreign exchange fees on card purchases, while most Australian banks charge you between 3-8% or even more. Fees are based on the Visa spot rate, which is one of the best we, as consumers, can get access to.

If you’re one of those who likes to lock in foreign currency rates in advance, you can do so with your Revolut account. Most major currencies are supported, and the whole process is as easy as possible.

Tip: if you’re planning an overseas trip and know you will spend at least $2,499, (for one month of travel) upgrading your account to Metal right before your trip makes sense. Metal will cost you $24.99 monthly, which means that the 1% cash back alone will pay your card fee. Apart from that, you will be able to use all the Metal features, such as increased ATM withdrawals, discounted lounge access, and SmartDelay lounge access, which gives you a free lounge pass if your flight is delayed by 1h or more. Keep in mind that if you cancel Premium or Metal within 10 months of being a paying member, you will be charged a 2-month cancellation fee.

Commbank Travel Card VS Revolut

People often ask me about the Commbank Travel Card and if it’s any good compared to Revolut, the short answer is: no, it’s NOT a good travel product. For starters, teh Commbank Travel Card charges $3.5 per ATM withdrawal, to make matters worse, the Commbank Travel Card also charges 3% on top of every overseas transaction you make with your card. Compare this to the 0% markup Revolut charges and you will quickly realise the Commbank Travel Card is potentially one of the worst products on the market.

Westpac Travel Card VS Revolut

While the Westpac Travel Card is much better than the Commbank Travel Card, it still doesn’t offer much competition in terms of benefits and features compared to Revolut. While the Westpac Travel Card doesn’t charge a foreign exchange fee, it does charge ATM fees when you’re not using one of its affiliated AMTs around the world. While the Westpac Travel Card lets you convert your money to 11 currencies, the Revolut card has access to 27+ currencies and the conversion rates are exponentially better than those set by Westpac.

Is Revolut Safe?

Yes, Revolut is a legit product and extremely safe to use. The company is regulated by ASIC in Australia, has a financial services line and is protected by a bank guarantee via an Australian authorised deposit-tanking institution that issues the benefits of a bank guarantee to Revolut account holders even though Revolut is not an Australian bank.

Essentially, if Revolut were to go under, your money is guaranteed via the independent Trustee.

Apart from that, Revolut has world-class security features to keep your money and card details safe.

What Else Can You Do With Revolut?

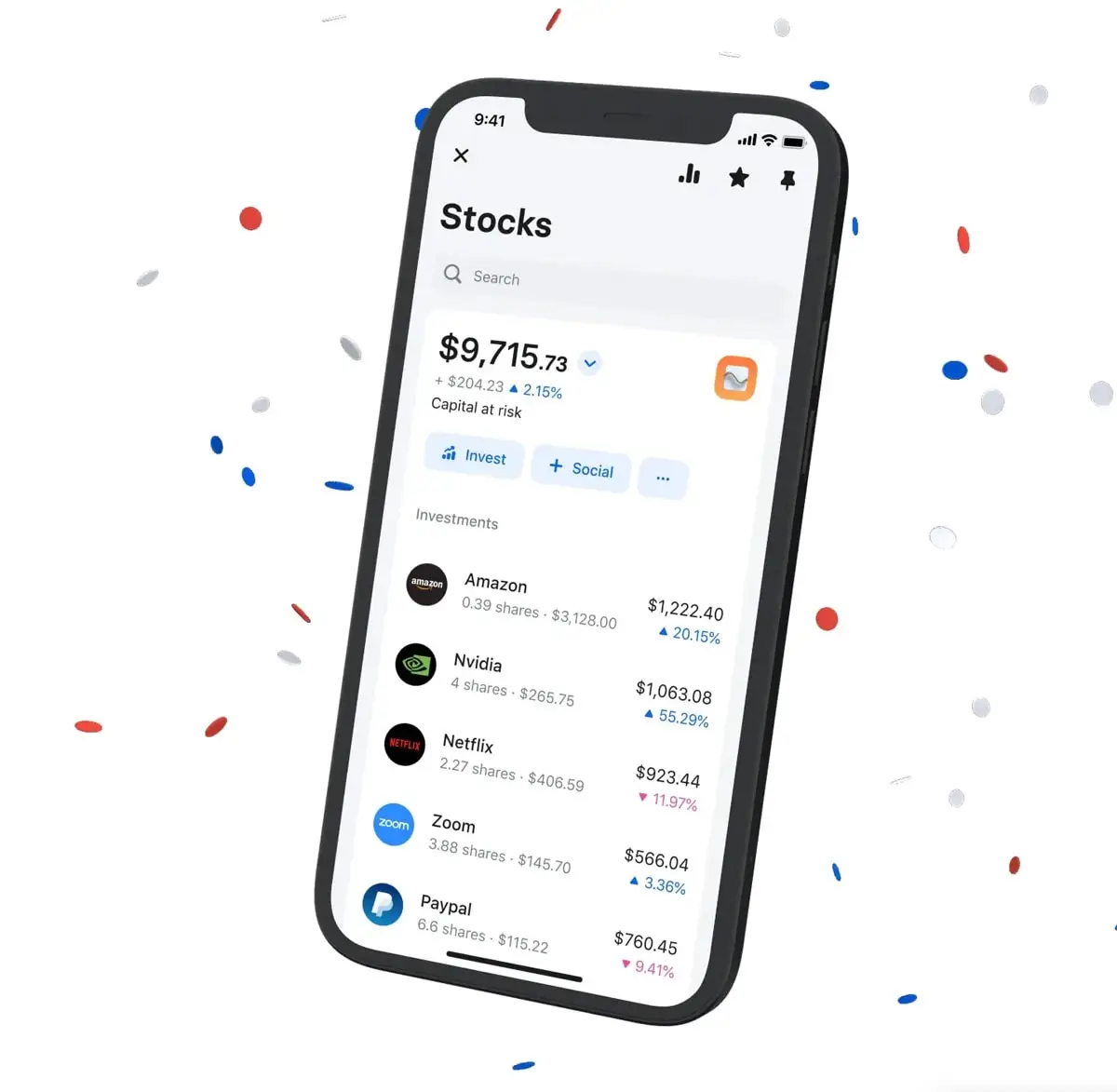

Revolut members can also use their account to buy crypto, fractional stocks, and precious metals and there’s even a cashback portal when you use the app the shop at your favourite stores.

Revolut referral code?

Of course, we’ve partnered with Revolut to offer Flight Hacks readers an exclusive account top-up of $15 when you sign up via our link and make at least 1 transaction. This is one of the most generous and easy-to-obtain Revolut referral codes and is also available to the Standard free Revolut account! To get this Revolut referral, just click this link to sign up. There’s no need to enter a specific Revolut Promo code when you click our link, the $15 account credit will be applied once you make your first purchase using your new Revolut card. The $15 account credit will be added to your account 10 days after making the qualified transaction. To be eligible you need to spend at least $1 using either a virtual card or a physical card, no later than 14 days after opening your account. See terms and conditions here.

Revolut Australia – Summing Up

I’ve been using Revolut since their launch in Australia back in 2019, having used the Standard and Metal account on and off; so far, it’s been a flawless experience with zero complaints. I think the only thing that would make this the “ultimate” travel debit card would be a rebate for foreign ATM fees; at this stage, only ING offers such a benefit, and I feel that Revolut could offer this feature to Metal users since they are already paying a hefty monthly fee.

All in all, Revolut offers a very innovative product to Australians who are looking for a debit card that does more than your average bank account.

Click here to join Revolut free & Receive a $15 account credit

Related posts