Ubank Debit Card Review

Unlock a $30 bonus with Ubanks’s referral code C7N1TAZ – enjoy no fees, and manage your money effortlessly

UBank is currently offering a huge $30 sign-up reward for newcomers who join with promo code C7N1TAZ and make five eligible card purchases within their first 30 days. A refer-a-friend scheme is also on offer, letting you share a personal invite code and pocket a bonus once your mates meet the same spending target.

How to pocket the $30 Free?

- Download the UBank app, open an account and enter C7N1TAZ during sign-up.

- Complete at least 5 qualifying card transactions within 30 days. (these are pretty much any type of purchase you can think of)

- Your Spend account should be credited with the $100 reward a few days after you hit the target.

How to refer friends

- Update the UBank app to the latest version.

- Grab your unique invite code under Settings.

- Share the code.

- When a friend joins with your code and makes five card purchases in their first 30 days, you’ll receive your referral bonus.

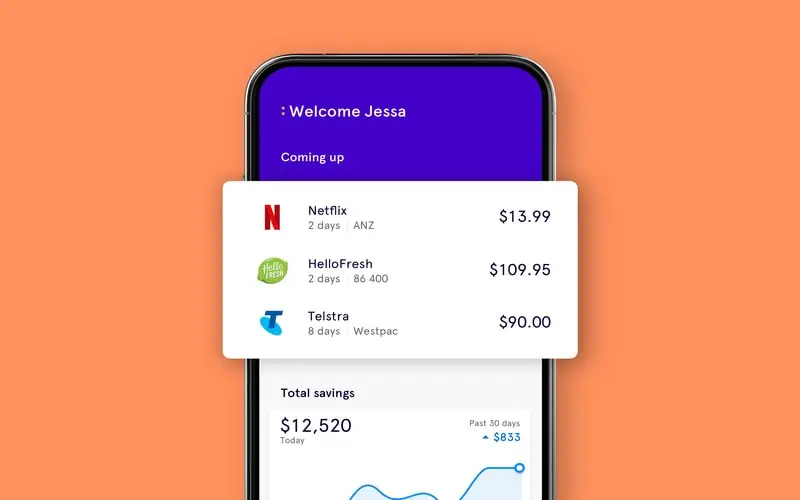

Ubank is a neobank that operates entirely via a mobile app (Ubank was previously called 86 400), with no desktop site or bank branches. Just like their name, Ubank isn’t what you’d expect from a traditional bank! Priding themselves in being one of Australia’s pioneering neobanks, 86 400 (now Ubank) stands for the number of seconds in a day.

The mobile-based bank uses innovative technology to provide customers with useful insights, personalised savings tools and minimal fees. Not to mention joining takes just minutes with no credit checks or income requirements.

Use our Ubank referral code for a free sign up bonus of $30 when you make 5 card purchases in 30 days. Use code: C7N1TAZ

Ubank referral code: Get $30 cash in your new account!

Sign up for the free Ubank bank account using our Ubank referral code C7N1TAZ to get $30 when you sign up! But you'll have to be quick - it's only for a limited time! To get the $30 you have to make 5 card purchases (the transaction amount can be anything!).

Where do I enter the code?

Once you've downloaded our app, make sure you enter the Ubank promo code you received on the 'About you' screen during the sign up process.

So what’s a Neobank?

Neobanks are simply banks which are completely digital. Although the word bank is generally associated with long queues, poor customer service and countless fees, neobanks promise to be different. They don’t even have physical branches!

What they do provide is all the banking services you need from the convenience of a smartphone app. They vow to deliver app-based banking that is easy to use and beautifully designed, with the ability to quickly track your spending whilst also delivering an excellent customer experience.

Is Ubank Safe?

At first, you may be apprehensive about the idea of a fully digital bank. Although, it is important to note that neobanks are regulated by the same authorities as traditional banks – the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investment Commission (ASIC). Plus, just like traditional banks, deposits of up to $250,000 per person are protected by the Financial Claims Scheme (FCS).

Ubank is now owned by nab, National Australia Bank Limited (abbreviated NAB) is of course of the four largest financial institutions in Australia.

Ubank Account Features

The Ubank bank account and debit card comes with all the features you would expect from a traditional bank plus more!

- No Fees: All the basics of a debit card with zero card, account or ATM fees

- Detailed Transaction History: Tells you who, when and how you paid

- Multi-bank Activity Tracking: Track your money across other banks, not just Ubank

- Account Funding: Top up your account with PayID or your BSB and Account Number

- Secure Card: Instantly lock and unlock your card from the app

- Contactless Payments: Support for Apple, Samsung, Google, Fitbit and Garmin

Ubank Is Great for Travel

While traditional banks will charge in excess of 3%, Ubank boasts zero currency conversion fees and zero international ATM withdrawal fees (although the ATM provider may charge a fee). Ubank uses Visa’s daily exchange rates without applying any markup.

Up to 5% p.a. Interest Rate

Ubank offers a decent savings interest rate of up to 5% p.a. (Welcome Bonus Rate for up to 4 months.). New customers who join Ubank on or after 15 July 2025 are eligible to receive a higher bonus rate on their Save account(s) for up to 4 months from the date of joining Ubank. Interest is calculated daily and paid monthly, with bonus interest applied on balances of up to $1,000,000 per customer. Existing customers get an interest savings rate of up to 4.35% p.a.

Eligibility Criteria

To be eligible for the Ubank bank account and debit card, you will need to meet the following requirements:

- Residency: Australian citizen or permanent resident

- Minimum Age: 16

- Personal Details: Hold either an Australian driver licence, passport or Medicare card

Is Ubank right for you?

Neobanks are setting a new benchmark for what a banking app should be, and truly showing just how far behind the big four really are. Although Ubank isn’t our favourite neobank out there, they do offer useful spending insights, various payment options, a good savings interest rate and almost zero fees.

Related posts