American Express Platinum Card

Unlock elite travel benefits, luxury perks, and unmatched rewards with the American Express Platinum Card.

Experience unparalleled rewards with the American Express Platinum Card. For a limited time, receive 200,000 Bonus Membership Rewards Points when you apply online by 25 August 2026, are approved and spend $5,000 on eligible purchases on your new American Express Platinum Card within the first 3 months. T&Cs apply. New American Express Card Members only.

The Amex Platinum Card is stacked with exceptional rewards and offers exclusive benefits like up to $400 in Global Dining Credit per calendar year, a $450 annual Travel Credit and lounge access. With the flexibility to transfer points to more than 10 major airline and hotel transfer partners, it's the perfect choice for those seeking to maximise their rewards and enjoy premium experiences. Terms and conditions apply.

Amex Platinum Key Benefits:

Receive 200,000 Bonus Membership Rewards Points when you apply online by 25 August 2026, are approved and spend $5,000 on eligible purchases on your new American Express Platinum Card within the first 3 months. T&Cs apply. New American Express Card Members only.

What is a charge card?

Essentially a charge card comes with flexible spending power, also known as no-pre-set spending limit. This means that the amount you can spend is dynamic and can adapt based on your transaction patterns, your businesses credit rating and other factors. The way you use your Card can help your spending power grow, particularly in the first few months. To help maximise your spending power, you can make regular transactions and don’t miss any payments.

This offers extra flexibility to those that need it. In addition to that, the full balance is required for each statement cycle, whereas with a credit card you could pay the minimum necessary + interest each month*.

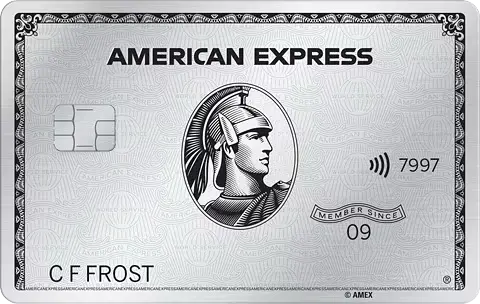

Amex Platinum Metal Card Design

The Amex Platinum Card now comes with a sleek, metal design for both primary and additional Card Members. Apart from the invite-only Centurion card, the Amex Platinum Card is one of the few metal card available in Australia

Amex Platinum Card Fees & Details

Earning & Redeeming Points With Amex Platinum

The American Express Platinum Card earns Membership Rewards Ascent Premium points. Out of all Amex reward points, these are considered the most valuable due to their transfer options to all the major frequent flyer programs including Cathay Pacific Asia Miles, Singapore Airlines KrisFlyer, Thai Royal Orchid and Qantas Frequent Flyer.

In addition to that you can also transfer your points to Air New Zealand, Emirates Skywards, Malaysia Airlines Enrich, Etihad Guest and Virgin Atlantic Flying Club. If hotels are more important to you, you can also transfer to Hilton Honors (however, we would classify this as a poor use of points) or Marriott Bonvoy.

Click here to learn more or apply via Amex.

Amex Platinum Airline Transfer Rates

Most airline partners except for Air New Zealand, Emirates, Qantas & Velocity transfer at a rate of 3 MR points for 1 frequent flyer point, this makes the effective earning rate of the American Express Platinum Card 0.75 points per dollar. When opting to Velocity or Qantas Frequent Flyer, the transfer rate is 2:1 making your effective earn rate 1.125 points per $1spent.

- 1 Velocity Frequent Flyer = 2 Membership Rewards

- 1 Qantas Point = 2 Membership Rewards points

- 1 Qatar Airways Avios = 3 Membership Rewards

- 1 British Airways Avios = 3 Membership Rewards

- 1 Asia Miles = 3 Membership Rewards points

- 1 Etihad Guest Mile = 3 Membership Rewards points

- 1 Enrich Mile = 3 Membership Rewards points

- 1 Flying Club Mile = 3 Membership Rewards points

- 1 Kris Flyer Mile = 3 Membership Rewards points

- 1 Skyward Mile = 4 Membership Rewards points

- 1 Airpoint Dollar = 200 Membership Rewards points

Amex Platinum Hotel Transfer Rates

The American Express Membership Rewards program also allows you to transfer your points to 2 of the major hotel loyalty programs Hilton Honors and Marriott Bonvoy.

Hilton Honors

- 2 Membership Rewards points = 1 Hilton Honors point

Marriott Bonvoy

- 3 Membership Rewards points = 2 Marriott Bonvoy points

Supermarket Transfer Rates

You can transfer your Membership Rewards to Woolworth's Everyday Rewards program. This also allows you to essentially transfer your Amex Membership Rewards to Qantas since Everyday Rewards can be converted to Qantas Frequent Flyer at a 2:1 ratio.

- Amex → Everyday Rewards: 5 MR = 4 ER

- Everyday Rewards → Qantas: 2ER = 1QF

- Effective Amex → Qantas: 2.5MR = 1QF

$450 Annual Travel Credit

Each year you hold the Amex Platinum Card you will receive a $450 travel credit which can be used to book flights, hotels and car rentals via Amex travel. The benefit of booking through Amex travel is that you will not pay any credit card fees, on top of that you also get bonus points. More complex travel itineraries are harder to price up online, but I find that A to B flights are always the same price compared to booking direct + you save on credit card surcharges applied by airlines and travel agencies. Note that the travel credit must be used in its entirety, if not you'll forfeit the difference.

How The Travel Credit Works

If your Card has a Travel Credit benefit, the Primary Card Member is eligible for an annual Travel Credit. The Travel Credit can be redeemed through American Express Travel Online on a single eligible travel booking by selecting the Travel Credit when you checkout.

To redeem the Travel Credit, the full value of the Travel Credit (or more) must be charged to the eligible Primary Card. Eligible travel includes flights, hotels and car hire when you prepay in advance. The Travel Credit can be used for 365 days from the benefit anniversary date and cannot be used past the expiration date.

To check the expiration date of your Travel Credit if you have not already redeemed it, please visit americanexpress.com.au/travel; log in and click ‘Travel Credit’.

If your booking is cancelled, and your Travel Credit has already been used and associated statement credit applied to your account, you will forfeit your annual Travel Credit benefit and American Express may reverse the statement credits issued.

You need to be able to spend on the Card to access the Travel Credit benefit and it should be credited to your Card Account within 3 business days but may take up to 30 days. Your account must be in good standing and you must have paid the annual fee and minimum payment by the due date.

If you cancel your Card, change your rewards program or Card type, you will no longer be eligible for the Travel Credit.

Up To $400 Dining Credit Each Year

Each year, Amex Platinum Card Members will receive up to $400 worth of dining credits.

The dining credit will be split into 2; this means you get $200 credit at a range of restaurants in Australia and $200 at selected venues around the world. The list and countries are extensive and include over 2,000 restaurants across 20 countries. Each restaurant is hand-selected by the American Express Platinum team. You can see the full list of participating restaurants here. This benefit has been extended and will run until December 31, 2026

- $200 Dining Credit: To be used each year at participating Australian restaurants

- $200 Dining Credit: To be used at participating international restaurants

Priority Pass Lounge Access

No airline status? No problem! Priority Pass is a global network of more than 1,800 airport lounges that offer access to its members based on a paid subscription. Fortunately for Amex Platinum Card Members, Priority Pass is free and unlimited (with the exception of Priority Pass Restaurants).

To further maximise the value, you can gift a second priority pass membership to one of your additional Platinum Card Members ( you can have 4 additional Card Members in total).

As part of the membership, you can also take a guest with you so in total you could get lounge access for up to 4 people when travelling together.

To enrol into Priority Pass you just need to call Amex on 1800 673 760 (option 3) since it’s not available online. The Priority Pass membership is valued at $531 per annum.

Virgin Australia Domestic Lounge Access

Your shiny Amex Platinum Card also acts as your membership card to all the Virgin Australia domestic lounges. This is unlimited, and you can take 1 guest in with you. This benefit is limited to the primary Card holder.

Annual Virgin Lounge memberships retail $420 + a $330 joining fee so we’ll value this benefit somewhere in the middle. Of course, you will need to be flying with Virgin Australia to take advantage of this benefit.

ALL Accor+ Explorer Membership

The Amex Platinum Card now comes with a complimentary ALL Accor+ Explorer membership (primary Card Member only). Personally, I would pay for this each year, so it’s a great addition. I wrote an ALL Accor+ Explorer Ultimate guide here so go check that out for the full details. Essentially you get two ‘Stay Plus’ complimentary nights (each complimentary night must be booked in conjunction with a paid night) at over 1,300 participating hotels in Asia Pacific, 30% off your food bill for up to 10 people at over 1600 restaurants and instant Accor ALL Gold status with a bonus 30 nights. Another perk of the membership is 15% off drinks in the Asia Pacific + much more. The ALL Accor+ Explorer membership would normally cost $349 per year but is included as part of your Amex Platinum Membership!

The complimentary nights can be redeemed for properties that easily go for $400+ a night, so it’s a win-win, add dinner for 2 to your hotel bill (30% discount), and you will easily save another $100 on that too.

Amex Platinum Travel

The Amex Platinum Card also has access to the Platinum Travel Service team. This is a service exclusive to Platinum Card customers, and the reason I’m mentioning this benefit here is because they can get discounted business and first-class tickets for Card Members.

On a recent quote I got for Qatar Airways, Amex Platinum Travel came back with a fare that was $400 cheaper compared to the cheapest I could find on Google Flights.

Fine Hotels + Resorts

Amex FH&R is a luxury travel program for over 1,600 iconic 5-star properties worldwide. It’s only available to Platinum Card Members and offers additional benefits such as guaranteed 4PM checkout, complimentary breakfast for two, upgrades (subject to availability) and special amenities at each property, such as US$100 food and beverage credit or massage for two.

The benefits vary between properties, but for those that seek out unique 5-star properties, it’s a win-win most of the time. I’m saying “most of the time” because of course you should always compare the prices to other booking sites and see if you’re actually getting a benefit by booking through FH&R. It’s similar to Virtuoso but more seamless since you can book online and the benefits are usually guaranteed (such as the 4PM late checkout).

Benefits Summary:

- 12pm check-in, when available

- Room upgrade on arrival, when available

- Complimentary daily breakfast for two

- US$100 credit per stay, unique to each property

- Complimentary Wi-Fi

- Guaranteed 4pm check-out

The Hotel Collection

The Hotel Collection is a similar program to Amex FHR but usually features a range of different properties. Amex Platinum Card Members get up to USD$100 hotel credit on qualifying charges and a room upgrade if available when you book The Hotel Collection through American Express Travel. The only catch is that it’s valid for bookings of 2 nights or more. You can research the available properties when logged into your Amex account and by clicking the “book travel online” link.

Hotel Elite Status

The Amex Platinum Card comes with a bunch of instant elite status for a few hotels. Here’s what you get:

- Hilton Honors Gold Status:Typically you will get upgrades to better rooms (provided there’s availability), and as part of your gold status, you also get complimentary breakfast (at most Hilton brands).

- Marriott Bonvoy Gold: Once you get the Amex Platinum Card, you can apply for Bonvoy Gold which should get you better upgrades, early and late checkout and better earn rates.

- Radisson Rewards Premium Status: Probably the least valuable hotel status, this one gives you a discount on food and beverages, free water in the room and a welcome gift as well as room upgrades where available.

The American Express Global Lounge Collection

American Express now has its own lounges in both Sydney and Melbourne, as a Platinum Card holder you get unlimited access for both yourself, additional Card Members + 2 guests to The Centurion Lounge.

You will also get complimentary access to international Centurion Lounges, a large number are found in the U.S, and there’s also a brand new one in Hong Kong.

Delta Skyclub

When travelling with Delta airlines, both the primary and additional Card Members get access to the Delta Skyclub.

Lufthansa Lounges

Platinum Card Members now get access to both the Munich and Frankfurt lounges. Both Business class lounges and Senator Lounges are up for grabs if you meet the following conditions: Lufthansa Business Lounges when flying in any class with Lufthansa, Swissair and Austrian Airlines. Lufthansa Senator Lounges when flying in Business class with Lufthansa, Swissair and Austrian Airlines.

Car Rental Elite Programs

Your Amex Platinum Card also comes with a couple of elite memberships to both Hertz and Avis.

- Hertz Gold Plus Five Star: This membership offers free upgrades (based on availability), priority car collection and a 4 hour grace period when returning the car. In addition to your status, there’s also a Platinum Charge coupon code which will reduce the total cost of your rental.

- Avis Preferred Plus: In addition to car upgrades (when available), members will also receive between 25 and 50% more Avis reward points.

Amex Platinum Card Insurance

The American Express Platinum Card comes with some of the most comprehensive travel insurance policies attached to a charge card. In addition to travel insurance, it also comes with comprehensive car rental insurance and Smartphone Screen Cover (I’ve personally used this multiple times already; easy claims process and the claimed amount was paid within days). As always, it’s hard to go into detail when it comes to insurance since everyone’s circumstances are different.

Therefore I would highly recommend you spend 15 mins reading through the PDS to see if it’s suitable for you. The Amex Platinum Card now also covers up to 4 additional Card Members, so it’s no longer just your immediate family/spouse that are covered.

This is a great benefit as you can now extend an additional card to friends or family members. Keep in mind that you are required to book your return tickets using the Card to be fully covered by insurance.

Amex Platinum Card Downsides

Apart from the hefty annual fee, there are a few other things that could be improved upon. For example, the 3% surcharge when spending in foreign currencies seems excessive considering this is a Card for those who travel a lot. It’s slightly offset by the 2.25 points per dollar earn rate overseas, but ideally, we would like to see no FX rates on this Card.

Maximising the additional cards

There’s a good reason for Amex to limit additional Cards to only 4 (of course there is no cost to adding additional Cards) on the Amex Platinum Card and that’s because they get pretty much all the same benefits as the primary cardholder. That includes most hotel statuses and lounge access plus insurances.

Note: Only 1 additional Card Holder gets Priority Pass while Accor Plus is limited to the Primary Card holder only.

Amex Experiences App

Amex Platinum Card Members get access to the Amex Experiences App which highlights the Card benefits and features and gives notifications about exclusive ticket pre-sales as well as information on which restaurants you can book to redeem your dining credit. The app is available via Google Play and the Apple App Store.

Amex Platinum Card In Conclusion

As you can see, there are plenty of benefits that justify the high annual fee for this Card. That being said, it certainly isn’t for everyone, especially if you don’t travel or see no value in lounge access, hotel status etc. Especially for the first year, this Card is an absolute no-brainer if you’re remotely interested in luxury travel thanks to the fantastic welcome offer!

Terms & Conditions

Your American Express Charge Card comes with flexible spending power, also known as no pre-set spending limit. This means that the amount you can spend is dynamic and can adapt based on your transaction patterns, your personal credit rating and other factors. The way you use your Card can help your spending power grow, particularly in the first few months. To help maximise your spending power, you can make regular transactions and don’t miss any payments.

Bonus & Eligibility. 200,000 Bonus Membership Rewards® Points are only available to new American Express Card Members who apply online by 25 August 2026, are approved and spend $5,000 or more on eligible purchases on your new Card in the first 3 months from the Card approval date. Eligible purchases do not include Card fees and charges, for example annual fees, interest, late payment, cash advances, balance transfers, traveller’s cheques and foreign currency conversion. Please allow 8-10 weeks for the bonus points to be credited to your Account after the spend criteria has been met. Card Members who currently hold or who have previously held any Card product issued by American Express Australia Limited in the past 18 months are ineligible for this offer. The American Express Platinum Card has an Annual Card Fee of $1,450. This advertised offer is not applicable or valid in conjunction with any other advertised or promotional offer.

(FHR) program benefits are available for new bookings made through American Express Travel with participating properties and are valid only for eligible Platinum Charge Card Members and Centurion® Members. Platinum Credit Card Members who are not also Australian Platinum Charge Card Members or Centurion® Members, are not eligible for FHR program benefits. Bookings must be made using an eligible Card and must be paid using that Card, or another American Express® Card, in the eligible Card Member's name, and that Card Member must be travelling on the itinerary booked. Noon check-in and room upgrade are subject to availability and are provided at check-in; certain room categories are not eligible for upgrade. The US$100 credit will be applied to eligible charges up to the amount of the credit. To receive the US$100 credit, the eligible spend must be charged to your hotel room. The US$100 credit will be applied at check- out. Advance reservations are recommended for certain US$100 credits. The type and value of the daily breakfast (for two) varies by property; breakfast will be valued at a minimum of US$60 per room per day. To receive the breakfast credit, the breakfast bill must be charged to your hotel room. The breakfast credit will be applied at check- out. If the cost of Wi-Fi is included in a mandatory property fee, a daily credit of that amount will be applied at check- out. Benefits are applied per room, per stay (with a three- room limit per stay). Back-to-back stays booked by a single Card Member, Card Members staying in the same room or Card Members travelling in the same party within a 24-hour period at the same property are considered one stay and are ineligible for additional FHR benefits (“Prohibited Action”). American Express and the property reserve the right to modify or revoke FHR benefits at any time without notice if we or they determine, in our or their sole discretion, that you may have engaged in a Prohibited Action, or have engaged in abuse, misuse, or gaming in connection with your FHR benefits. Benefit restrictions vary by property. Benefits cannot be redeemed for cash and are not combinable with other offers unless indicated. Benefits must be used during the stay booked. Any credits applicable are applied at check- out in USD or the local currency equivalent. Benefits, participating properties, and availability and amenities at those properties are subject to change. To be eligible for FHR program benefits, your eligible Card Account must not be cancelled. For additional information, please call the number on the back of your Card.

An annual ALL Accor+ Explorer Membership is valued at AU$349, found

at accorplus.com/au/benefits as at 1 October 2025. Eligible American Express Card Members are required to enrol to receive a complimentary ALL Accor+ Explorer membership. An ALL Accor+ Explorer membership is available only to the Primary Platinum Card Member. Membership privileges will only be granted on presentation of a valid membership card and a member must identify themselves as an ALL Accor+ Explorer member at time of booking. Accommodation bookings must be made in advance through the ALL.com app. American Express reserves the right to instruct Accor Plus to cancel your membership if you cease to be a Platinum Card Member or your Account is not in good standing. Complimentary membership is a continuing benefit of your American Express Platinum Card, however American Express reserves the right to discontinue the benefit, upon providing you with reasonable notice. Once

enrolled, enrolment continues for at least 12 months. If you become ineligible for this benefit or if this benefit ends, the ALL Accor+ Explorer membership standard eligibility criteria will apply to you. A Stay Plus Free Night may be subject to availability at participating properties. Use of the Stay Plus is subject to the conditions as listed on accorplus.com/au/terms-and-conditions. Membership privileges are subject to exceptions listed at accorplus.com/au/benefits-exceptions. Dining and drinks discounts do not apply to room service, mini bars, meeting rooms, selections from the kids’ menus or takeaways; and public holidays or during special events. For more

information, please visit here: accorplus.com/benefits/more-flavours. Dining privileges are subject to the Accor Plus membership terms and conditions which are found here: accorplus.com/au/terms-and-conditions.

Maximum amount back is $200 on spend at participating local restaurants (Local Dining Credit) and AUD$200 on spend at participating abroad restaurants (Abroad Dining Credit) per redemption period: Each redemption period resets on 1 January until the offer end date of 31 December 2026. The redemption periods are: 1 January – 31 December 2025 and 1 January – 31 December 2026. Spend can be in one or more transactions. You cannot carry any unused offer value from one redemption period into the next.

▪ Primary Card Member Only: The Benefit is only available to Primary American Express Australia Platinum Card Members using their Platinum Personal Charge Card. Transactions made with an Additional Card is not eligible for this Benefit.

▪ Save this Benefit First: A one-time enrolment is required. You must first save the Benefit to your Platinum Card before making your payment to qualify for the Benefit. Benefit limited to the Card to which the offer is saved and only spend on this Card counts towards the Benefit. If you use another card to make a payment at any time, you will not be eligible for the Benefit on that card. If you switch to a new Card product that is not eligible for this Benefit, enrolment will be removed from your Card Account. If a Card you hold is ineligible, you will not be able to see the Benefit, nor will you be able to save the Benefit to the Card. If you are no longer eligible for this Benefit due to a change in Account status, including but not limited to fraudulent flags, suspension or cancellation, it will be removed from your Account.

▪ Eligible Transactions: Benefit only available for dine-in services made in-person at a participating restaurant in Australia. Full participating restaurant list can be found here. Participating restaurant list subject to change without notice, please check before you dine as you won’t be eligible to receive a credit if the restaurant isn’t on the list at the time of your transaction.

▪ Excluded Transactions: Benefit excludes purchases of gift cards and vouchers, transactions made towards deposits charged upfront by the venue, booking, cancellation, and no-show charges, takeaway or dine-at-home services.

▪ Direct Payments Only: If you pay using payment processors such as QR payment or restaurant in-app purchases, you may not be eligible for the Benefit. Please request to pay at the restaurant’s designated checkout register. ▪ Award of Credits: Credit(s) should appear on your billing statement within 30 days from the date of payment but may take longer. Credit(s) are not redeemable for cash or any other payment form. Credit may be reversed if your qualifying purchase is refunded or cancelled.

▪ Expiry or Withdrawal of Benefit: The Benefit will expire on 31 December 2026. American Express can withdraw the Benefit at any time by giving you 60 days’ notice.

▪ Your use of participating restaurants: Your purchase of goods and/or services from the participating brands is governed by their respective terms and conditions (including privacy policies). American Express is not responsible in any way for the goods and/or services of the participating brands. Inquiries or complaints related to the participating brands' goods and/or services should be directed to their customer service.

▪ Our General Offer Terms: Our General Offer Terms also apply to the Benefit and contain important additional terms.

Related posts