The ANZ Rewards Program is worth knowing about when looking for a flexible points program. ANZ Rewards allows you to earn points on everyday purchases, which can then be redeemed for rewards such as gift cards and entertainment experiences. You can also use your points for accommodation, free flights and transfer you points to various airline frequent flyer programs.

Plus, if you make a purchase with one of ANZ’s bonus partners, you can earn additional bonus points. Most ANZ rewards cards will also come with a signup bonus points offer to kickstart your balance.

In this post:

What are flexible reward programs?

Flexible reward programs are loyalty programs which allow you to collect points in their own currency and then transfer to partner programs at a later date. For example, you could collect points with said flexible reward program then transfer to Qantas Points after deciding you want to book a redemption flight. The biggest advantage of a flexible reward program is, no pun intended, flexibility. You can hold onto your points and then make a decision on how to use them later.

Most flexible rewards programs have multiple airline partners which can be hugely beneficial when it comes time to redeem your points for flights — simply because you will have more options. Keep in mind that each flexible reward program has different exchange rates.

ANZ Rewards Eligibility

ANZ has 2 separate types of Points-earning credit cards; Qantas Frequent Flyer and ANZ Rewards.

Most people confuse both cards as the same, however ANZ allows those who currently hold or have held an ANZ Rewards card within the last 12 months to apply and receive the bonus Reward Points on the ANZ Frequent Flyer card range.

This rule is the same the other way around too, so if you currently hold or have held an ANZ Frequent Flyer card, you can sign up for any of the ANZ Rewards cards and receive the bonus Reward Points if you meet the other conditions.

Essentially there are 2 categories of cards: ANZ Rewards and ANZ Qantas Frequent Flyer.

The ANZ Card Range

There currently 4 cards available which will earn you ANZ Rewards Points, all cards come with sign up bonuses and have different earn rates; here are the current offers:

ANZ Rewards Classic

Earn Rate:

- 1 Reward Point per $1 spent on eligible purchases up to and including $1,000 per statement period

- 0.5 Reward Points per $1 spent on eligible purchases above $1,000 per statement period

ANZ Rewards Platinum

Earn Rate:

- 1.5 Reward Points per $1 spent on eligible purchases up to and including $2,000 per statement period

- 0.5 Reward Points per $1 spent on eligible purchases above $2,000 per statement period

ANZ Rewards Black

Earn Rate:

- 2 Reward Points per $1 spent on eligible purchases up to and including $5,000 per statement period

- 1 Reward Point per $1 spent on eligible purchases above $5,000 per statement period

ANZ Rewards Travel Adventures

Earn Rate:

- 1.5 Reward Points per $1 spent on eligible purchases up to and including $2,000 per statement period

- 0.5 Reward Points per $1 spent on eligible purchases above $2,000 per statement period

How to earn ANZ Reward Points

It is easy to earn points with ANZ Rewards, all you have to do is flash your plastic at the checkout. The number of points you’ll earn depends on the card you choose, ranging from 0.5 to 2 points per $1 spent. The earn rate also decreases when you reach a certain limit.

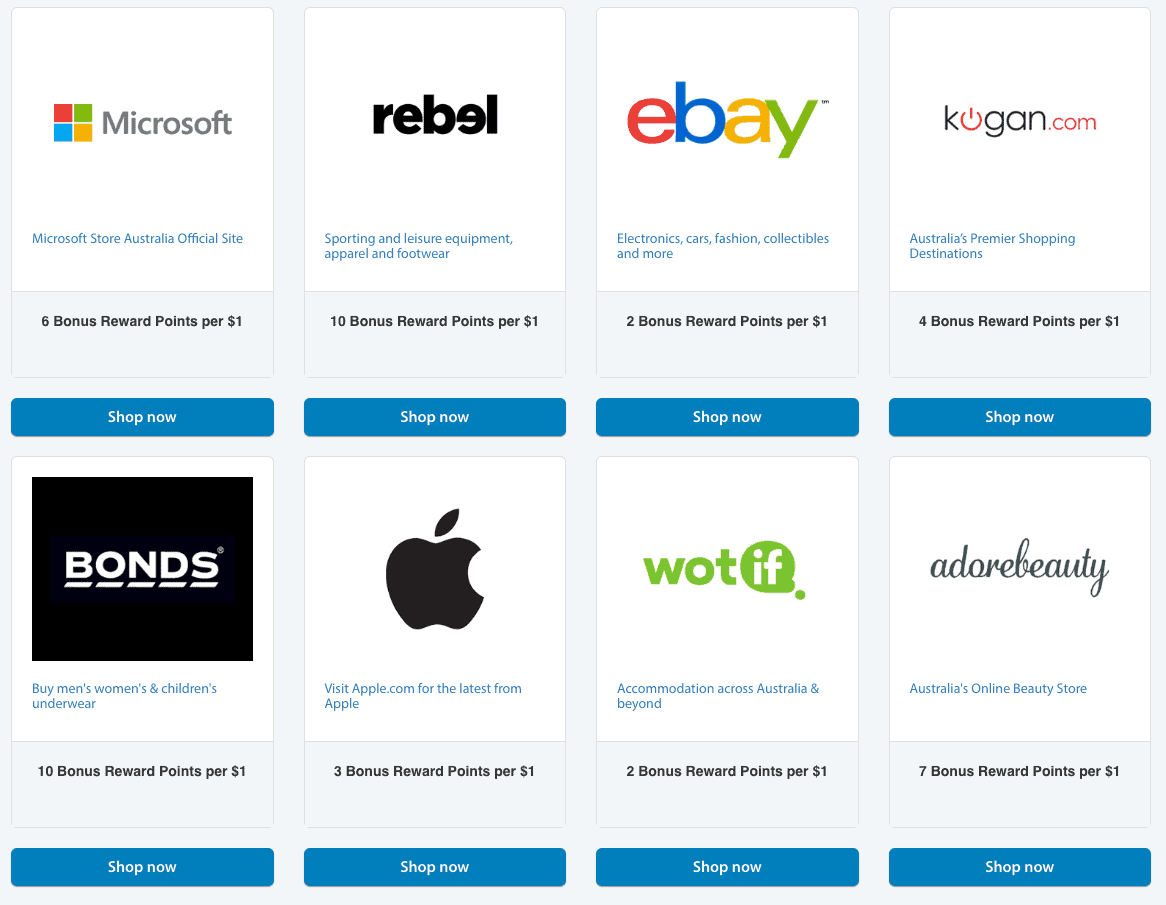

Bonus point offers are also available when you shop online through the ANZ Bonus Points Mall. For example, you’ll earn an extra 10 bonus points per $1 spent with Bonds, David Jones, Cotton On, Rebel and more.

The Rewards

The ANZ Rewards Program has many ways in which you can redeem your points. Redemption options can be split into four main categories:

- Travel – Redeem your points for hotel accommodation, free flights, flight upgrades and car hire. You can also transfer to KrisFlyer Miles, Airpoints Dollars and Asia Miles.

- Vouchers and gift cards – Redeem your points for gift cards to stores including Myer, JB Hi-Fi, Woolworths, Bunnings Flight Centre and more.

- Entertainment – Redeem your points for movie and theme park tickets, magazine subscriptions, and experiences such as jet boating and Indoor Skydiving.

- Retail products – Redeem your points for a variety of products from the newest iPhone to chainsaws!

Frequent Flyer Partners

ANZ Rewards partners with the frequent flyer programs of Virgin Australia, Singapore Airlines, Air New Zealand and Cathay Pacific.

- Singapore Airlines KrisFlyer: 3 ANZ Rewards points will get you 1 KrisFlyer mile. You must transfer in multiples of 1,500 ANZ Rewards points.

- Cathay Pacific Asia Miles: 3 ANZ Rewards points will get you 1 Asia Mile. You must transfer an initial minimum of 3,000 ANZ Reward Points and then in multiples of 1,500 ANZ Reward Points.

- Air New Zealand Airpoints: 200 ANZ Rewards points will get you 1 Airpoints Dollar. You must transfer a minimum of 3,000 ANZ Rewards points and then in multiples of 1,500 ANZ Reward Points.

ANZ Rewards Conclusion

ANZ Rewards is definitely worth considering as a great flexible points program. The range of redemption options is excellent, and the flexibility of the program means you can hold on to your points until you decide how to spend them. One downside of the program is the slightly lower earn rate when considering the transfer rate to frequent flyer programs, but that is the price you pay for flexibility.