You’ve probably heard of the big four banks, customer-owned banks and maybe even online banks, but have you heard of neobanks? Welcome to the world of money management alternatives that are about to change Australia in a big way. This beginner’s guide is an introduction to what neobanks are, and a comparison between Australia’s top three.

In this post:

What is a Neobank?

Neobanks are simply banks which are completely digital. Although the word bank is generally associated with long queues, poor customer service and countless fees, neobanks promise to be different. They don’t even have physical branches, which may be a deterrent for some potential customers, although neobanks aren’t really targeting that demographic. What they do provide is all the banking services you need from the palm of their hand, 24 hours a day. They vow to deliver app-based banking that is easy to use and beautifully designed, with the ability to quickly track your spending while also delivering an excellent customer experience.

Neobanks offer similar products to regular banks such as everyday and savings accounts, with some even offering home loans. In all honesty, neobanks are setting a new benchmark for what a banking app should be, and truly showing just how far behind the big four really are.

Are Neobanks safe?

Neobanks are regulated by the same authorities as traditional banks – the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investment Commission (ASIC). They hold the same licences as and are regulated in the same ways as traditional banks.

Neobanks hold an Authorised Deposit-Taking Institution (ADI) licence, which means deposits of up to $250,000 per person are protected by the Financial Claims Scheme (FCS). This is exactly the same as any other Australian bank. Some neobanks accounts are issued through partner banks, such as Up which issues through Bendigo and Adelaide Bank.

What are the advantages of Neobanks?

Neobanks have many advantages over traditional banks. Here are some of the benefits:

– Detailed transaction history: Tells you exactly who you paid, including the full company name and often a logo, when you paid down to the minute and the suburb where the transaction was made

– Detailed spending insights: Daily, weekly and monthly insights which detail the amount you spent, what you spent it on, and how your spend compares to previous periods

– Budgeting tools: Allows you to set up simple personalised budgets

– Round up savings: When enabled each transaction is automatically rounded to the nearest dollar, with the amount rounded put in a savings account

– Voice banking: Make payments or check your balance voice assistants including Siri and Google

– Travel perks: Most neobanks offer 0% international transaction fees plus free foreign ATM withdrawals

– Contactless payments: Mobile wallet integration with services like Apple Pay, Google Pay and Samsung Pay

– Instant payment: Most neobanks offer New Payments Platform (NPP) technology which makes for near-instant transfers to other banks with Osko

Australia’s Top 3 Neobanks

Australia’s top neobanks are arguably Up, 86 400 and Xinja. After testing all three, I made the following conclusions.

Joining

Setting up an account with each platform was straightforward and much faster than joining a traditional bank. The process for each is almost identical. As well as basic details like your name and email, your identity is confirmed using your drivers licence, medicare card or passport. I was ready to go with each provider in less than 10 minutes, as below.

- Xinja: 5min 3sec

- 86 400: 6min 42sec (use code: C7N1TAZ to get $10 when you sign up!)

- Up: 8min 67sec

Adding each to Apple Pay was super easy, meaning I could use my account almost immediately.

Adding Funds

Xinja’s instant top up feature makes it easy to transfer funds from another bank account. After adding a debit card to the app, you can top up with between $20 and $1000 straight from the Xinja app. Unfortunately, credit cards, prepaid cards and international cards do not work with this service. You can also add funds to your account using your Xinja BSB and Account Number.

Up also makes it easy to add funds by automatically creating a PayID using your Upname (username). You can also change this to the phone or email linked to your account. From there, you can transfer money instantly to Up just like you would to a friend with PayID. You can also add funds to your account using your Up BSB and Account Number.

86 400 has the least attractive method of adding funds. Although PayID is soon to come, for now, customers must add funds using their BSB and Account Number. If the bank you are transferring from supports Osko payments, the money should arrive straight away.

Cards

All three neobanks say their cards should arrive within 10 working days, although often it will be much sooner than that. My Xinja card arrived in 5 business days, while 86 400 and Up arrived in 6 business days.

All three cards are brightly coloured, looking nothing like a traditional bank card. Xinja and Up are powered by Mastercard while 86 400 is powered by Visa. You will find your card number printed on the back of the cards, which means you can’t use your camera to scan the card into apps. Up has used quite small text for the card number which makes it hard to read at times.

Up and Xinja allow users to lock and unlock their cards from the app, although 86 400 has no such option. Up even allows you to configure your card and turn things like ATM withdrawals, contactless payment and online purchases on or off.

Payment Options

Considering many are transitioning contactless payment using digital wallets, being compatible with these platforms is important for any bank. The below table shows which of the major digital wallets each neobank is capable with.

| 86 400 | Up | Xinja | |

| Apple Pay | Yes | Yes | Yes |

| Google Pay | Yes | Yes | Yes |

| Samsung Pay | Yes | Yes | not yet |

| Fitbit Pay | Yes | Yes | not yet |

| Garmin Pay | Yes | Yes | not yet |

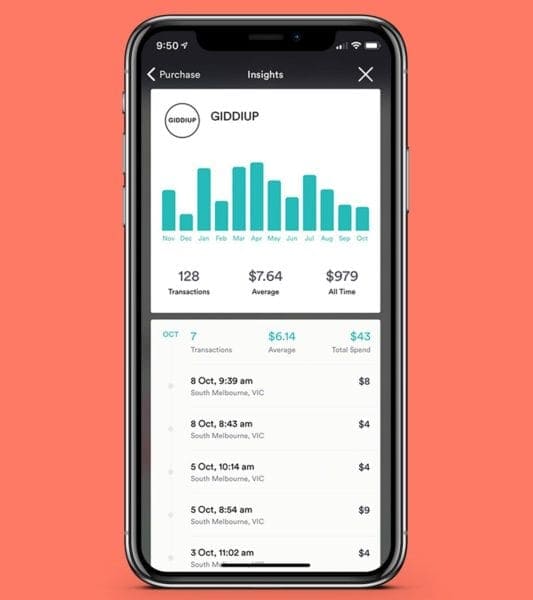

Insights and spend tracking

Up’s activity section is well designed, showing transaction history and other events. A business logo and business name is shown for almost all transactions, making it much easier to identify where you have spent. The monthly overview is a useful addition, broken down into spending categories. You can even click on a particular retailer to see a range of insights. For example, you could see how much and when you spend at a particular coffee shop or supermarket. One thing I didn’t like is the inclusion of events like ‘card activated’ and ‘upname claimed’ mixed into transactions.

Xinja and 86 400 also have well-designed transaction history pages, but show nowhere near the amount of insights as Up. While they do show more detail into each transaction compared to traditional banks, in my experience, they don’t provide much insight into your spending.

Only 86 400 can track your spending across “all your accounts” including other banks to gain a single view of your spending. While most major banks are listed and easy to connect, amusingly Xinja and Up are not included!

Fees

Neobanks tend to be far more transparent about their fees, which are pretty much zero.

| 86 400 | Up | Xinja | |

| Account opening fee | Nil | Nil | Nil |

| Service fee | Nil | Nil | Nil |

| Direct Debits | Nil | Nil | Nil |

| Domestic ATM fee | Nil* | Nil* | Nil* |

| International ATM fee | Nil* | Nil* | Nil* |

| International transaction fee | Nil | Nil | Nil |

| Overdraft fee | N/A | 11.23% p.a. | N/A |

| Direct debit dishonour fee | Nil | Nil | Nil |

| Card replacement | Free | Free | 1 free p.a. then $10 |

*ATM provider may charge a fee

International Travel Perks

One awesome benefit for travellers heading overseas is zero currency conversion fees, zero international card payment fees and zero international ATM withdrawal fees across all three neobanks. Although, keep in mind that like using any card at a competing bank’s ATM, the provider may charge a fee. Most often, the ATM will show any applicable fees and ask if you want to proceed with that fee. The same applies for international purchases. Although most often there isn’t a fee, I still have to say that it is possible.

To work out the currency conversion rate, Xinja and Up both use Mastercard’s daily standard FX rate, without applying any markup. 86 400 uses Visa’s daily exchange rates, again without applying any markup.

By comparison, traditional banks often charge a myriad of fees which are somewhat complex. Apart from other fees, the big four charge an international transaction fee of around 3% for purchases, around $5 per ATM withdrawal plus any provider fees and they will often charge a markup on currency conversion also! For an entire trip, these fees continue to add up. Plus, why pay fees if there is an alternative.

Interest rates

Because neobanks have considerably lower overheads, they generally offer more competitive interest rates. The below table compares the current interest rates of each neobank’s savings accounts.

| 86 400 | Up | Xinja | |

| Base rate p.a. | 0.25% | 0.10% | 2.25% |

| Bonus rate p.a. | 1.60% | 1.75% | 0.00% |

| Total rate p.a. | 1.85% | 1.85% | 2.25% |

Note, Xinja is not opening new Stash accounts at the moment, due to the COVID-19 crisis.

Summing Up: My Take

Of the three neobanks I tested, Up was my favourite and the one that I will continue to use. In my opinion, Up has the best layout, far better insights and more features than Xinja and 86 400. In saying that, I will continue to use Xinja because of their higher interest rate for savers.