Complete Guide To Flexible Credit Card Reward Programs In Australia

We explain flexible rewards programs and reveal which Australian banks offer the best transfers to programs like Velocity, Qantas and KrisFlyer.

It’s no secret that credit cards are one of the best ways to earn frequent flyer points in Australia. There are several cards that earn Qantas Points or Velocity Points, but the real power of spending on plastic emerges with flexible banking rewards.

There’s a reason banking loyalty programs like Amex Membership Rewards, Westpac Altitude and NAB Rewards are so popular. Because you can sit on your balance until the prefect reward seat appears, then transfer those points to Velocity, Qantas, Cathay, KrisFlyer and other partners.

This guide explains how flexible rewards programs work, the major Australian banks offering flexible rewards and which frequent flyer schemes you can transfer to. Hopefully by the end of this guide, you’ll know exactly which flexible card best suits your wallet.

What Are Flexible Reward Programs?

When you go to sign up for a rewards credit card, you’ll find two varieties: co-branded airline frequent flyer cards and flexible rewards cards.

Co-branded cards are simple enough, with every dollar you spend transferring straight into the specified airline frequent flyer program (eg. 1 Velocity point per $1 spent). On the other hand, the flexible rewards system allows you to earn points in a separate currency and then transfer these points elsewhere, such as an airline frequent flyer program. You can also use bank rewards points for other redemptions, such as gift cards and reward store products, although redemptions offer far less value.

Advantages Of Flexible Reward Programs

Funnily enough, the biggest advantage here is flexibility! Here’s a few advantages to earning flexible rewards points;

- Earn points on your daily spend without being locked into a specific airline and relying on their award seat inventory.

- Ability to research which program offers the best redemption price and has reward seat availability for your route and dates, before making a transfer. AwardHacker is great for comparing the prices that airline partners charge on the same route.

- If one frequent flyer scheme devalues, your points remain safe until you're ready to transfer.

- Regular promotions with an average 10-30% bonus points when transferring to certain partners.

- Non-travel redemptions from iPhones to chainsaws! Though these almost always offer poor value.

Disadvantages Of Flexible Reward Programs

Flexible reward programs can add complexity to travel hacking, but there aren’t too many disadvantages;

- Genuinely speaking, flexible rewards credit cards have lower signup bonuses and earn rates, once you factor in a transfer.

- For maximum value, you'll spend more time working out which partner program is best.

- Transfers aren’t always instant, which can be risky if award availability disappears before your transfer completes.

Major Flexible Rewards Programs In Australia

Australia is home to a number of flexible rewards programs offered on credit cards. The Major players are;

- American Express Membership Rewards

- CommBank Rewards

- NAB Rewards

- ANZ Rewards

- Westpac Altitude Rewards

- Amplify Rewards (St. George, Bank of Melbourne, Bank SA)

- Virgin Money Rewards

- Suncorp Rewards

- HSBC Rewards

- Citi Rewards

Each program offers a different mix of transfer partners, earn rates, and redemption options.

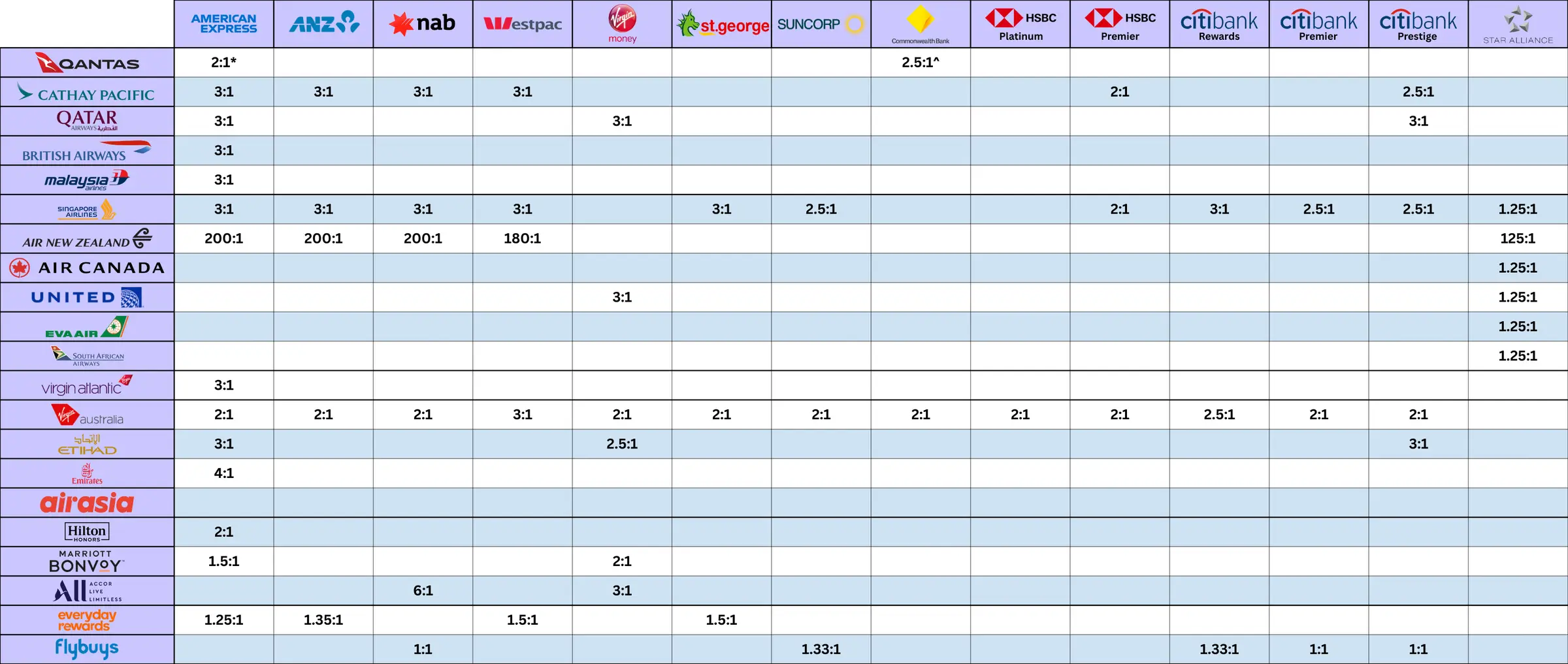

Frequent Flyer Transfer Rates For Australian Credit Cards

When selecting the best card for your needs, it is important to consider the transfer rate of competing programs, as well as the earn rate for that card. These rates will vary between programs and partners, with some offering far more favourable conversion ratios than others. For example, a 2:1 Amex to Velocity transfer ratio would mean every 2 Membership Rewards Points gets you 1 Velocity Point.

The table below provides a comprehensive comparison of the transfer rates offered by major Australian credit card rewards programs to frequent flyer, hotel, and supermarket partners.

*Amex Platinum cardholders only.

^Via opt-in to auto transfers, which carries a $90 annual fee.

Why Are Qantas Transfer Options So Limited?

Back in 2009, Qantas Frequent Flyer axed its relationship with most flexible rewards programs. It was a decision made to force cardholders to sign up for Qantas-only credit cards if they wished to earn Qantas Points.

The exception here is the high-end American Express Platinum and Westpac Altitude Business, which still offer transfers to Qantas Frequent Flyer. Unless you’re looking at one of these premium cards, if you’re after Qantas Points, a co-branded card is the easiest way to do it.

This would restrict you to the Qantas ecosystem, which as readers would know, can tend to offer extremely limited Classic Reward availability for Business and First Class.

Best Flexible Rewards Credit Cards

What About Non-travel Redemptions?

While most Flight Hacks readers would be interested in frequent flyer points, flexible rewards programs also offer non-travel-related redemptions. It is important to do your homework here, as these redemptions usually represent poor value.

Non-travel redemption options can be split into three main categories;

- Gift cards - gift cards for a collection of retail stores

- Entertainment - Experiences such as movie and theme park tickets

- Retail products - Products from the latest iPhone to chainsaws!

Related posts