HSBC Offers Brand New Star Alliance Credit Card For Australia

Earn Star Alliance points and unlock premium perks with the new HSBC Star Alliance Credit Card!

Last week we shared details perhaps mistakenly released on the all-new Star Alliance Credit Card. As of today, applications are now open for the HSBC Star Alliance Credit Card, with Australian-based frequent flyers locked in as the launch market.

It’s a world-first by a global airline alliance, and certainly an innovative concept for an airline frequent flyer credit card. Cardholders will be able to earn points across Star Alliance partnered carriers, and even unlock a fast-track to Gold status with some of those airlines, including Singapore Airlines, EVA Air, and United Airlines.

Star Alliance CEO Jeffrey Goh says the new alliance-wide credit card was the outcome of many strategic discussions with its airlines.

“It [the card] will offer a new world of loyalty experience with not only the ability to earn points, but also a fast track to Star Alliance Gold Status through everyday spending.”

There’s quite a bit to say here, so strap yourself in for the ultimate Flight Hacks take on the HSBC Star Alliance Credit Card.

Fast Track To Star Alliance Gold Status

The HSBC Star Alliance credit card has launched in Australia with one huge benefit – a fast track to Star Alliance Gold status. To unlock membership in your first year, you’ll need to spend at least $4,000 on eligible purchases within the first 90 days from account opening. When joining, you will be asked to nominate a Star Alliance ‘Status Airline’ as the program that you wish to receive Gold status in.

For now, the HSBC Star Alliance credit card offers seven airline partners;

- Air Canada

- Air New Zealand

- EVA Air

- Singapore Airlines

- South African Airways

- Thai Airways

- United Airways

For Australian frequent flyers, we recommend selecting either Singapore Airlines KrisFlyer or United MileagePlus as your Status Airline. That’s because Star Alliance Gold status in those programs offers Virgin Australia perks such as domestic lounge access and priority check-in. No matter which airline you select, Star Alliance Gold-level perks will be honoured across all Star Alliance partner airlines.

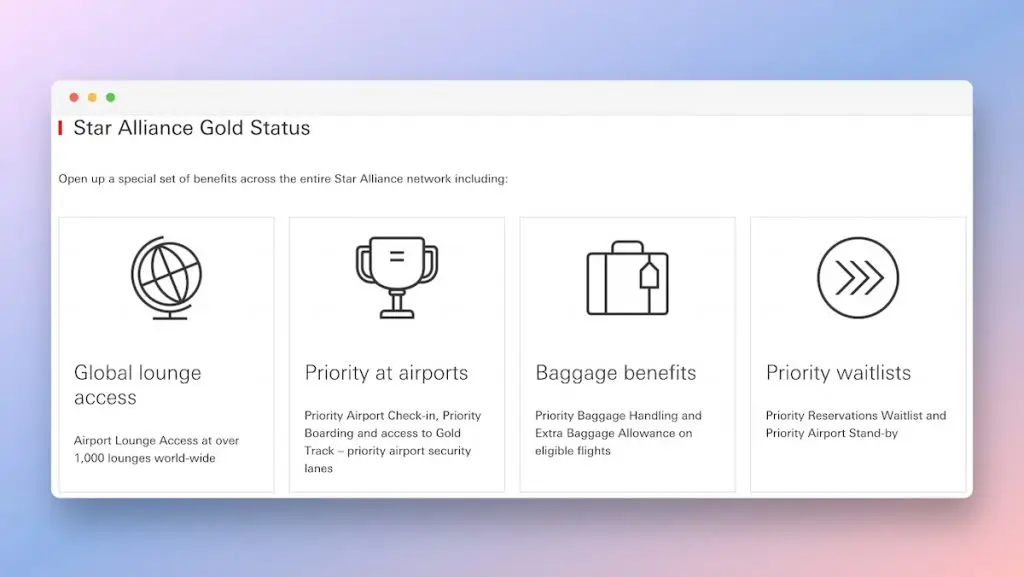

Benefits Of Star Alliance Gold Status

Star Alliance Gold members receive exclusive perks when travelling with any of the group’s member airlines. Those benefits include’

- Priority airport check-in

- Priority boarding

- Priority baggage handling

- Additional baggage allowance

- Airport lounge access

- Gold Track premium security

- Priority reservations waitlist

- Priority airport standby

Retaining Star Alliance Gold Status With HSBC

You can retain your Star Alliance Gold tier by spending at least $60,000 on eligible purchases in each 12-month period from account opening. That’s the equivalent of spending $5,000 on your HSBC card every month. Although, if you fall short cardholders earn Star Alliance Silver Status by spending at least $30,000 on eligible purchases in a qualification year. This works out to a more reasonable $2,500 on your HSBC card every month.

KrisFlyer Elite Gold status is equivalent to Star Alliance Gold status and unlocks lounge access worldwide, provided you are travelling with a Star Alliance member airline. You will also receive an increased checked baggage allowance, plus priority check-in, boarding and baggage.

Like most card promotions, there is a bunch of small print to read, which you can find on the HSBC Star Alliance card listing or the Star Alliance website. Most importantly, your complimentary status is maintained only by making the necessary spend and not by flying. It is also worth noting that if you cancel your HSBC Star Alliance card, your status will likely be terminated shortly thereafter.

Likewise, balance and cash transfers, business expenses, cash advances, BPAY, government payments, account fees, disputed transactions and other promotions are not counted towards your minimum spend for retaining Star Alliance Status.

Earn Points With Star Alliance Rewards

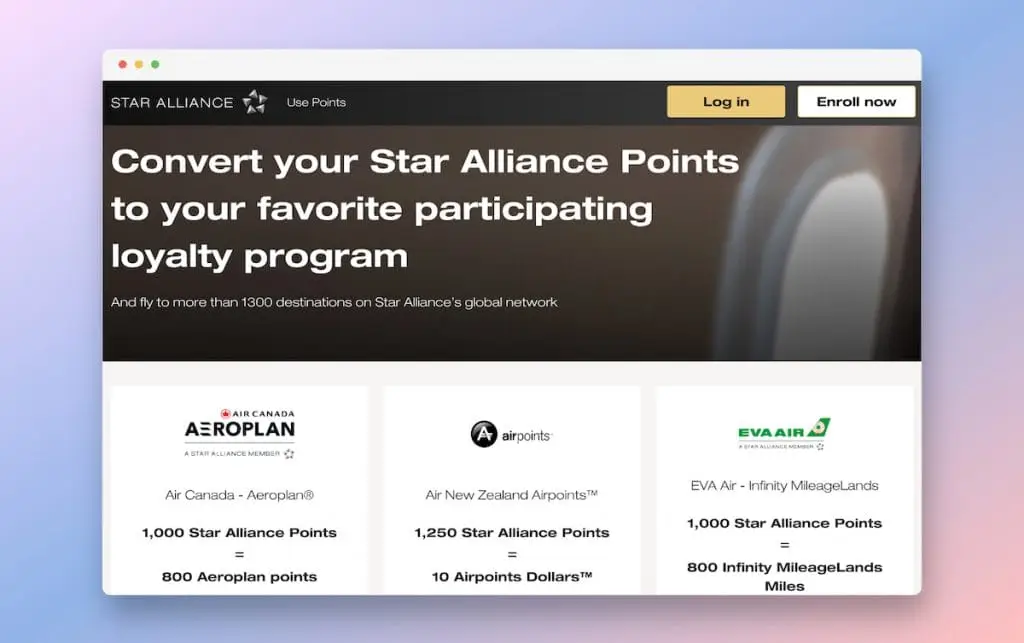

The home of this new loyalty standard is Star Alliance Rewards, a separate rewards wallet where your Star Alliance Points are stored. From the online portal, members can transfer a particular number of points to a participating Star Alliance carrier’s airline frequent flyer program.

The Star Alliance Rewards portal is completely separate from your Status Airline. For example, you could receive Gold Status with United MileagePlus and still have the option to transfer some points to Singapore Airlines KrisFlyer.

Converting Star Alliance Points To Airline Miles

With most programs, 1,000 Star Alliance Points will get you 800 airline points or miles. Here are the starting transfer rates;

- Air Canada: 1,000 SA Points = 800 Aeroplan points

- Air New Zealand: 1,250 SA Points = 10 Airpoints Dollars

- EVA Air: 1,000 SA Points = 800 Infinity MileageLands Miles

- Singapore Airlines: 1,000 SAPoints = 800 KrisFlyer miles

- South African: 1,000 SA Points = 800 Voyager miles

- Thai Airways: 1,000 SA Points = 800 Royal Orchid Plus miles

- United Airlines: 1,000 SA Points = 800 MileagePlus Miles

This makes Star Alliance Rewards truly flexible, with a huge choice of airline redemptions up for grabs, some of which aren’t even Star Alliance members. For example, Air Canada’s Aeroplan recently partnered with Vietnamese airline Bamboo Airways. After sending your Star Alliance Points to Aeroplan, you can then redeem them across the Bamboo Airways network. For example, you could redeem Aeroplan Points to fly from Melbourne to Hanoi in Bamboo Business.

HSBC Star Alliance Card Earn Rates

There are certainly some issues with this brand-new card, making it less appealing than Star Alliance would like to think. Chief among these is the rather limiting earn rate. You’ll earn 1 Star Alliance Point per AU$1 spent, for the first $3,000 in each statement month. After that, earnings are capped at just 0.5 Star Alliance Points per AU$1 spent.

Because most partnered airlines follow the same transfer rate, you will effectively earn 0.8 airline points/miles, once you’ve transferred, per dollar on the first $3,000 spent. This drops to a woeful 0.4 airline points/miles per dollar for the rest of that statement month.

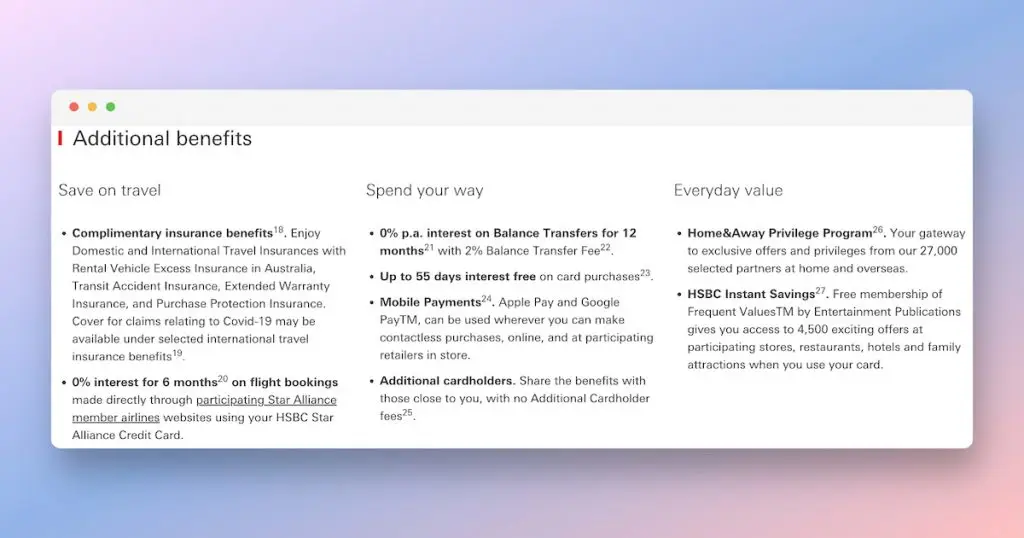

Additional Perks Of The HSBC Star Alliance Card

- Complimentary insurance benefits that include domestic and international travel insurance, rental vehicle excess insurance in Australia, transit accident insurance, extended warranty insurance, and purchase protection insurance.

- Add additional cardholders and share the benefits with no additional cardholder fees

- Home&Away Privilege Program exclusive offers with 27,000 partners

- HSBC Instant Savings exclusive offers at over 4,500 cafes, restaurants, hotels, apartments, cinemas, groceries, petrol and much more

Summing Up: My Take

While the introduction of an alliance-wide credit card is quite exciting, as are flexible reward programs in general, the HSBC Star Alliance Card lacks any significant appeal. While we think Star Alliance has taken an amazing step forward, the only real benefit is the fast track to Gold status after spending $4,000 in 90 days. From then on, the requirement to maintain Gold status by spending $60,000 on card is unappealing and means the regular Australian frequent flyer would be missing out on better deals with other cards.

For example, KrisFlyer Gold status is unlocked by earning 50,000 Elite Miles within 12 consecutive months. That is the equivalent of two return Business Class trips from Australia to Europe, which could be had for under $20,000. Of course, there are also cheaper routes that earn enough miles for Star Alliance Gold Status.

The other drawback of the new Star Alliance card is its earn rate. While low earn rates aren’t exactly uncommon in Australia, the HSBC card also lacks a signup bonus, which could have made up the card’s lacklustre day-to-day earn. All up, it is safe to say the current promotion offered on the HSBC Star Alliance Credit Card is unappealing unless you desperately want Star Alliance Gold Status. Plus, if you already hold such status, there is little to no benefit in applying. Therefore, we hope HSBC will launch an improved offer in the future.

Are there better deals? Yes! If you value flexible rewards and want the option to earn at the highest uncapped rate for Visa, the St George Amplify Rewards Signature Visa credit card with a generous sign-up bonus should be on your list to consider!

HSBC Star Alliance Fees and Charges

- Annual fee: $0 in the first year ($450 thereafter)

- Cash advance fee: 3% or $4 (whichever is higher)

- Interest free period: Up to 55 days

- Interest rate for cash advances: 21.99% p.a.

- Interest rate for purchases: 19.99% p.a.

- Overseas exchange fee: 3%

- Minimum credit limit: $6,000

- Minimum income: $75,000 p.a.

Applications for the HSBC Star Alliance Credit Card can be made directly with HSBC.

Related posts