Dr. Suess Inspired The Launch of New Qantas Premier Mastercard

Unlock premium benefits with Qantas Premier Mastercard: earn points, enjoy travel perks, and exclusive rewards.

Qantas launches Dr. Seuss’s poem inspired campaign “Oh, the places you’ll go! for their impressive new Premier Mastercard.Applications are now open.

“There is such a strong emotional connection with the Qantas brand, and given credit card spend by nature is transactional, this campaign has given us a platform to connect those two things and show people all the places they can go with their bonus Qantas Points upon sign-up, and the points they build when they use their card every day.” said Qantas chief marketing officer, Stephanie Tully.

WatchOh, the places you’ll go!Video.

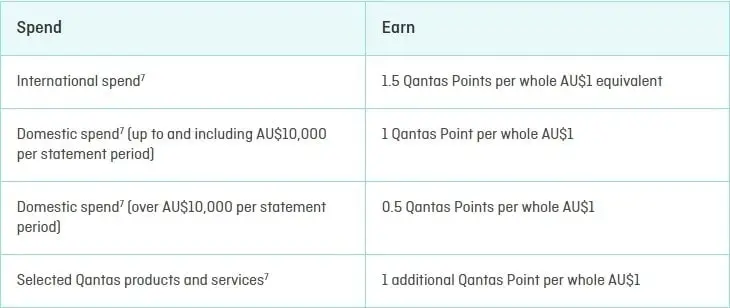

While some perks like the uncapped points potential may seem appealing, the tiered earned rates may still apply to heavy spenders. Cardholders, however, can earn points every day, either at home or overseas. Additionally, when cardholders spend $3,000 within 90 days from the application approval, 60,000 bonus Qantas Points will be awarded.

Here are the points earning breakdown:

ANNUAL FEES, INTEREST RATES & CHARGES

At the moment Qantas has a special offer where cardholders will pay a reduced annual fee of $149 for the first year and in subsequent years will pay an annual fee of $299.Qantas Premier Mastercard is the first credit card from Qantas Money which was designed with Qantas Frequent Flyer members in mind – to reward them.

Then, there’s also a 3% international transaction fee and a minimum credit limit of $6,000.

More information on interest rates for retail purchase, cash advance rate and interest-free period can be found here.

There’s also a 6 month interest-free on any first purchases from Qantas flight tickets and Qantas memberships. With every purchase, cardholders could earn up to 2 Qantas Points for every $1 spent. This applies to any Qantas EpiQure wine purchases, Qantas store, and Qantas Gift Vouchers.

On the downside, there are several transactions that are excluded from earning points. To name the specifics, government or government-related transactions including transactions via the Australian Post, Australian Taxation Office, tolls, parking, public transport fares, fines and other court-related costs, will not earn points. This business operation transaction won’t earn cardholders points either.

Fortunately, cardholders can look forward to a 0% balance transfer for 15 months. It’s currently an offer that will last for any application before 31st August 2017. Once the introductory period is over, any balance remaining from the balance transfer will incur a standard cash advance rate at 2.99% per annum.

OTHER FEATURES AND TRAVEL BENEFITS

International Airport Lounge Access. Cardholders get to enjoy 2 single complimentary access to International Business Lounges and Qantas Clubs. With each subsequent year, cardholders can request for 2 more invitations to the lounges. Lounges that are excluded from access is theLos Angeles Tom Bradley Terminal International Business Lounge.

Save 20% When You Travel With Friends or Family. Use the card to enjoy a 20% save when you book selected Qantas and QantasLink flights directly through Qantas Premier Concierge. Cardholders can fly with up to 8 companions.

Travel Insurance. The complimentary travel insurance is as comprehensive as any other travel insurance offered in the market. It covers the primary card members which also includes spouse and dependents whom could also be supplementary card holders. The travel insurance cover includes travel and flight inconveniences such as flight cancellation, flight delay, baggage, money and document cover andmuch more.

Qantas Premier Concierge. Receive assistance from Qantas especially dedicated to cardmembers from anywhere and anytime. Services include proving flight, hotel and car rental booking, destination and shopping information, Party planning, flower delivery and much more.

Fraud Protection. Feel secure with the built-in protection of the Mastercard Zero Liability. All cards allow cardholders to claim for any lost or stolen card due to theft.

There is quite a wide range of Qantas Frequent Flyer Credit Card. The new Qantas Premier Mastercard can serve as an added if not a better alternative that has unique features that other cards may not be able to offer to a certain group of members.

Related posts