Velocity Daily By Visa: Guide

Earn bonus Velocity points with Visa's Velocity Daily program—link your card and boost rewards!

If the 1950’s and 60’s were the ‘so-called’ golden age of flying, it wouldn’t be a stretch to call the new millennium the ‘golden age for points & miles connoisseurs’.

The Australian credit card market is awash with hundreds of cards, some offering monster sign-up bonuses, free lounge access, various insurances, all kinds of hotel elite status (without as much as ever setting foot inside the hotel) and more.

The points & miles bonanza doesn’t stop there. In-fact sign-up bonuses are just the proverbial ‘bone’ American Express, Visa, MasterCard & co. throw at you to lure you in. Then they bombard you with myriad ways of earning ‘bonus’ points & miles on your daily spend.

I will be the 1st to put my hand-up and admit that I am hooked to the Amex Local Champion bonus points program. Last year, I earned just under 5,000 local champion bonus points, most of those coming from my local supermarket (Coles).

But it doesn’t have to stop there, you can fill-up at BP and earn bonus Velocity points, shop online at Woolworths and earn bonus Qantas points and so on. To be sure, these points are over and above the points earned on credit cards.

To give you an example, if you shop at Woolworths online through Qantas Mall, for each dollar you spend, you can potentially earn, 2 Qantas points, 1 Woolworths Rewards points, plus if you paid with the Amex Platinum Edge Card, another 3 points. Do that, and you walk away with an unbelievable 6 points per $ (admittedly across 3 different currencies) quicker than you can say the words ‘points stacking’. And we haven’t even considered the numerous other carrots dangled at you by Woolworths in terms of earning hundreds of extra bonus points by purchasing certain items during a specified period. All this for doing what you do anyway, and there’s no surcharge or minimum spend on this.

Then there’s Velocity e-store where Apple recently offered 4 Velocity points per $. If you were in the market for a new iPhone X, that was a great time to purchase it. Between the bonus points earned through the e-store and points earned on your credit card, you could have walked away with enough points to fly Syd-Mel or Syd-Bne in economy class, with some points left over. And yeah, the shiny new iPhone too.

The mind boggles. ????

That brings me to the topic at hand, the newly launched Velocity Daily program by Visa.

What is Velocity Daily

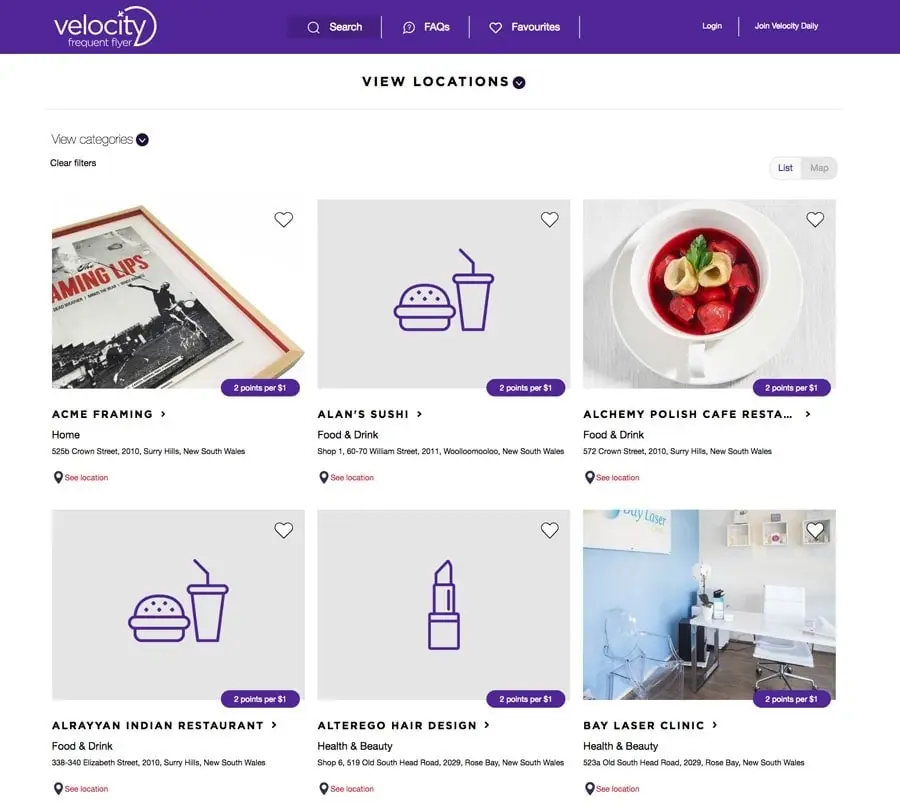

Visa & Velocity have teamed up with a small number of businesses (expected to be expanded nationally later) in Sydney where if you link your Visa card to your Velocity Daily Account and pay at those businesses with the linked Visa card, you will earn anywhere from 2-5 Velocity points on top of the points earned directly through your card. If you haven’t signed up to the Velocity daily yet, you can do so here.

A vast majority of these businesses are offering 2 Velocity points per $, with a minuscule number offering 3 – 5 points. To further entice people into using the program, it offers a one-off 500 bonus Velocity points on your 1st transaction. That’s well and good you say, but how does the Velocity Daily program stacks up on an ongoing basis, you may ask.

Example scenario:

One of the businesses partnering under Velocity Daily is Jack’s Café in Eastern suburbs of Sydney. It’s also one of the two businesses offering 5 points per $.

- a) Let’s say you went to Jack’s cafe for lunch one afternoon and spent $50. On this, your points earn will be (250 + 50 + 500 = 800 points).

That is an unbelievable return of 16 Velocity points per $ and a total no-brainer. If you haven’t yet taken advantage of this offer, you have until 30th June to do it. Anyway, I digress.

Say you got fantastic service and loved the food so much that you decided to return. Let’s also assume you spent the same $50 on your second outing and paid with the same Visa card. On this occasion, you will walk away with a still pretty respectable 300 Velocity points. 6 points per $ is a fantastic deal any day of the week.

The alternative to this could be to pay with the highest earning Amex Card, Amex Platinum Charge Card (3 points per $ on dining). In this scenario, it would have got you 150 points only, half of the linked visa card. And although Amex Ascent premium points (this is what you earn on Plat Charge) are far more valuable than Velocity points, one could argue that it’s more lucrative to pay with the Visa card and earn twice the no. of points. This, however, isn’t always true as you will see further down.

- b) Now let’s assume you went to another cafe offering 2 Velocity points per $ and spent the same $50. This will see you earn a total of 150 Velocity points, not a bad outcome. But the same amount paid through Amex Platinum Charge would have you earn 150 Amex Ascent premium points. It needs no explaining that 1 Ascent premium point holds much higher value than 1 Velocity point. Amex is the clear winner here.

- c) Now let’s assume you went to a bookstore or a florist offering 2 Velocity points per $. For simplicity’s sake, let’s assume you spent the same $50 and paid with the linked Visa card. You walk away with 150 Velocity points. Now, since you are smart and know this game inside out, you realise that paying with Amex Plat Charge is a poor choice as it will give you a paltry 50 points, so you whip out the Amex Explorer which will see you walk away with 100 Amex Gateway points, which essentially convert to 75 Velocity points.

Prima-facie that sounds like a bad deal, but sometimes, numbers only tell you half the story. You see, both Velocity and Amex sell points. Velocity points can be bought for anywhere between 3.6c/point to 2.3c/point. The more points you buy, the cheaper they get, capped at 50,000 points per year.

To arrive at an average price, let’s assume most people buy 25,000 Velocity points for $677, costing them 2.7c/point. For more details on how you can buy Velocity points and the price, look here .

You can also buy Amex points directly from Amex for a flat 2.5c/point. Firstly I find it curious that Velocity would price its own currency at a premium to Amex when you can simply buy Amex points and always transfer it over to Velocity program 1:1 and often with a 15% bonus. Anyway, as the Chinese expression goes, ‘we live in interesting times’.

I digress again so I won’t go too much into it as that’s a whole new topic by itself, but I value 1 Velocity point at 1.2c and 1 Amex Gateway point (this is what you earn on the Amex Explorer card) at 1.7c. Your valuation may be different to mine, but I would wager that most points & miles collector would ascribe at-least 50% premium to Amex currency over Velocity.

On that valuation, the 150 Velocity points are worth $1.80, and the 80 Amex Gateway points are worth $1.70. Suddenly the valuation gap has closed and knowing which card to use is no longer a no-brainer. When you further delve into the flexibility aspect, and a whole range of airline and hotel transfer partners Amex offers, one could argue that on this transaction at least, there is actually more value to be had by earning less Amex points than seemingly more (in numbers) Velocity points.

The Crux

The crux of the matter is that in points & miles game, 1 is frequently unequal to 1. What you see is rarely what you get. And although the business of valuing different point currencies is open to numerous methodologies and interpretations with no universally right or wrong answers, doing few simple calculations and understanding different uses of the currencies, can help us maximise their value.

Related posts