I’m Zipping It All

Zip your bags, skip the stress – travel smarter with our ultimate packing hacks and tips!

I can’t believe I’m saying this, but I’m now using Zip Pay to (almost) all my Visa/Mastercard transactions.

Now, before you click away in disgust, hear me out! Things are better than they seem…

Some history

If you’re not familiar, buy now pay later schemes are all the rage right now. Zero regulation, instant approvals, it’s “not an evil credit card”; it’s the Wild West! Let’s be real here. Buy now pay later programs are modern-day payday lenders. Call it what you want, but it’s essentially the same customer base.

Things are changing!

For me, the main reason to use a credit card is to earn rewards and points. Simple. I don’t care about the interest rate, I and most people reading this site use their card as a tool to A) access credit while our money works for us and B) get rewarded for the money we already spend; lastly, since I don’t see credit cards as a loan, I pay my balance in full when it’s due for obvious reasons.

That said, this isn’t exactly how most Australians use and see credit cards, so there’s always been a negative stigma around them. Most people are scared of credit cards because they don’t understand it. Whenever I’m at a checkout I can’t but help look to see what type of cards people use to pay, majority of the time it’s either a debit card or a low-interest rate credit card. Crazy. This is where Zip and AfterPay come in, it doesn’t look like a credit card so all is good; right?

Ok, I digress. Back to the “buy now pay later thing”.

Because I’m only interested in points and have never understood lay-by (what happened to saving up your money and then buying what you want??) I’ve always written of AfterPay and Zip as a tool for the desperate to get themselves even further in debt.

I was wrong.

You see, these days Zip and AfterPay offer the option to pay the balance with your credit card. AfterPay even started accepting American Express, and I have a feeling Zip will follow.

But here’s where things get interesting. Before using any service, I ask myself: what’s the benefit to me? I don’t care about paying back shit in 4 easy payments! Why would I sign up to Zip?!

Introducing rewards, cashback and other deals…

Zip has recently been super aggressive with its user acquisition; they are doing this by offering cashback on transactions and other deals and savings by using their platform.

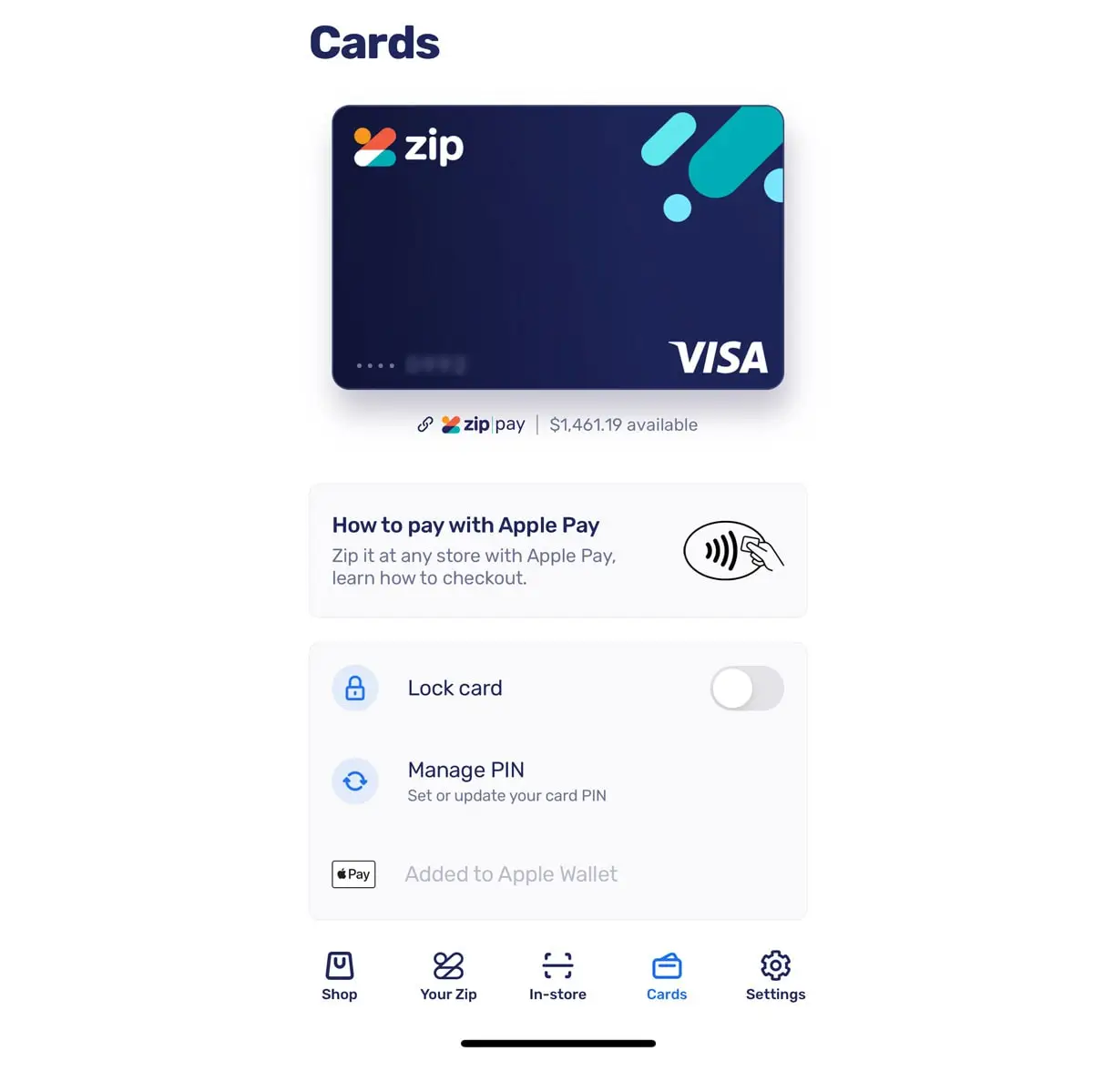

Zip also partnered with Visa to offer a “virtual” credit card (well, they won’t call it that but it is what it is!) which means you can Apple Pay anything and anyone that accepts Visa, you can even generate virtual card numbers to sign up to online services etc.

So here’s the process

- Get Zip

- Add virtual card to Apple to Google pay.

- Pay using Zip Visa

- Get 3% cashback until the end of the month + 10% cashback on Saturdays. (here are the full details on this promo: https://zip.co/promotion/rewards)

- Pay off your Zip balance with a points-earning Visa or MasterCard. I’m using my ANZ Frequent Flyer Black card to earn 1 QF points on every dollar up to $7.5k per statement period. You can get this card now with a huge sign-up bonus of 120,000 Qantas Points; feel free to sign up via our link if you enjoyed this post!

- Repeat

Limitations

Services like Zip are pretty much unregulated and hand out credit to MOST people (if you can’t get approved for Zip, you have serious credit problems). It’s not like applying for a credit card where you need proof of income, birth certificate, the colour of your eyes, blood type and proof of full ancestry (I’m just kidding but if you’ve applied for a card recently, you know how hard it is to get approved!).

Zip, on the other hand, is allowed to hand out credit like candy but only small amounts. Everyone starts with $1,000, and after a few months, you can get a max of $1,500 in credit. While this is fine for teenagers or those who simply don’t spend a lot (good for you). Most people would find this low limit annoying at most; paying off multiple times a month is a workaround for this.

Is there a credit check?

Yep, most people don’t believe this, but there is a credit check with Zip. While most free credit score websites don’t show it on your report if you get a full Equifax report ZIP is most definitely there. That said, for me, there was no negative impact.

Summing Up – Should You ZIP it?

Why not? I’m now Zipping most things where I can use ApplePay, especially with the 3% cashback promo, it’s actually the most rewarding way to pay right now.

I’m hoping Amex will soon partner with Zip as they did with AfterPay which would be fantastic. Cash back + points is just great!

Currently, the cashback offer is only on for a limited time, so the chances are that this will be reduced or removed in the future, however since Zip Rewards seem to take up a prominent section within the app, it would suggest that this is only the beginning for a full-on rewards/cash back system.

Are you ready Zipping it? Let me know!

Ps: If you have a friend who’s Zipping it already, ask them for a referral. I believe there’s a $5 promo on offer. I would, of course, love to give you my referral link but since my account is relatively new, I don’t have one.

Related posts