For frequent flyers and points nerds alike, the ability to earn Qantas points on insurance premiums can be quite enticing. With this trend, Qantas insurance has grown over recent years to become one of the largest insurance brands in Australia.

Qantas Insurance offers four main policies, with the introduction of home insurance soon to come. Plus, you can also earn Qantas points through the Qantas Wellbeing App.

Also interesting: The best Qantas credit cards for 2020

In this post:

Qantas Car Insurance

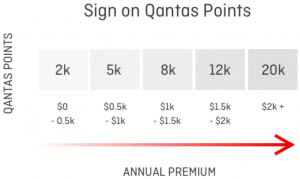

Until June 30, new Qantas Car Insurance customers can score up to 20,000 points as a signup bonus, 2 points (normally 1) per $1 spent on their premium, as well as the chance to win one of 20 $1000 BP gift cards. Qantas Car Insurance is issued by Auto & General Insurance, with three car insurance types on offer, as below.

- Comprehensive Cover

- Third Party Property, Fire and Theft

- Third Party Property only

In terms of the signup points bonus, this will differ based on the premium of your policy, with 20,000 bonus points awarded on annual premiums over $2,000.

Bonus points will be awarded after the policy has been held for 60 consecutive days. Note that you will not be eligible for the signup bonus points if you held a Qantas Car Insurance policy on the same vehicle during the 6 months prior to your new policy purchase date.

You can earn additional points for completing various tasks through the Qantas Wellbeing App (more on that later). These challenges include checking your tyre pressure and booking your car in for a service.

Qantas Health Insurance

Right now you can score up to 120,000 bonus Qantas points for taking out a Qantas Health Insurance policy before 30 June 2020. The signup bonus on offer differs for each policy depending on the type of cover you select and will be shown during your quote.

Points are awarded once the policy has been held for 60 continuous days. Additionally, if you have held a health insurance policy with Qantas, nib, AAMI, Apia, GU Health or Suncorp within the previous 6 months, you will not be eligible for bonus points.

As well as the signup bonus, you will also earn 1 Qantas point for every dollar you spend on your premium (excluding any Government rebates).

Qantas Health Insurance is issued by nib health funds limited.

Qantas Life Insurance

New Qantas Life Insurance customers can earn up to 100,000 bonus Qantas points for taking out a life insurance policy. Eligible policyholders must spend at least $25 per month to receive a signup bonus, with a minimum monthly spend of $300 to earn the maximum 100,000 points. Bonus points will be credited in 8 equal monthly instalments, commencing once the policy has been held for 60 consecutive days. Policyholders must spend the same qualifying premium and keep payments up to date in order to receive each points instalment.

Note that if you are an existing Qantas Life Insurance policyholder or have held a Qantas Life Insurance policy within the last 12 months, you are not eligible for this offer.

As well as the signup bonus, you will also earn 1 Qantas point for every dollar you spend on your premium.

Qantas Life Insurance policies are issued and claims are administered by TAL Life Limited.

Qantas Travel Insurance

Qantas Travel Insurance policies are managed by nib Travel Services, with four products on offer:

- Australian Comprehensive

- Australian Baggage and Cancellation

- International Comprehensive

- Annual Multi-Trip (12-month comprehensive cover)

With Qantas travel insurance, you will earn 1 Qantas point per $1 spent on your premium. Additionally, the Annual Multi-Trip product comes with 1,000 bonus Qantas points. Policyholders are eligible for their points upon departure, although it may take up to 6 weeks for the points to be credited to your Qantas Frequent Flyer account.

Qantas Wellbeing App

The Qantas Wellbeing App is a great way to boost your Qantas points balance through everyday activities, including sleeping!

Qantas Frequent Flyer members will get a 28-day trial when they first download the app, allowing you to earn up to 1,000 Qantas points without purchasing a Qantas Insurance policy. After your trial has ended, you will continue to earn points at a reduced rate, up to a maximum of 2,000 points per year. Although, if you take out an eligible policy with Qantas Insurance, you will continue to earn points at the same rate, up to a maximum of 20,000 points per year.

There are many activities which can earn you points through the Qantas Wellbeing app, including:

- Daily sleep health challenges

- Daily and weekly steps, cycling or swimming challenges

- Competing against family or friends in the weekly Friends Step Challenge

- Completing the Master of Rings Challenge for Apple Watch users

- Car-related tasks like checking your tyre pressure

- Inviting friends to the app

Summing up

The ability to earn Qantas points on insurance premiums is great. Despite this, it can be costly for points to be the only reason you select a particular insurer. It is always a good idea to compare other insurers before making your decision so that you can get the best offer for your situation.

Other Articles You May Like: